The World Bank has developed a collection of resources to provide capacity-building to emerging and developing economies on assessing and managing their fiscal risks. An extensive program of on- and off-site technical assistance, in-person and virtual workshops, knowledge products, and analytical tools help deliver these advisory services. These resources are grounded in the following pillars:

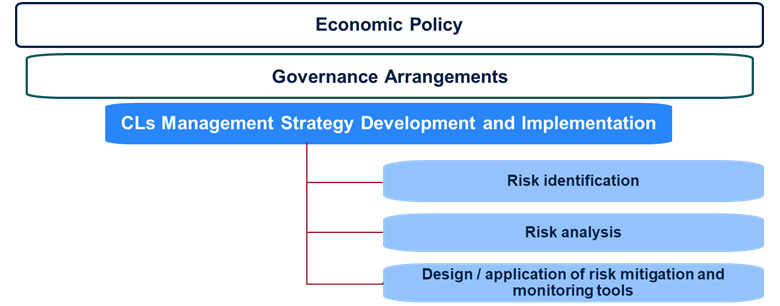

- Fiscal Risk Assessment (FRA): FRA is a framework to identify and assess the fiscal risks to which a country is exposed. This is a diagnostic tool to identify direct and contingent liabilities and map them into a fiscal risk matrix. Such mapping helps countries capture the big picture and develop a broad understanding of their exposure to fiscal risks. The FRA framework also assists the prioritization of risks by quantitative and qualitative assessment where possible, considering likelihood and impact. Ultimately, FRA findings allow for customized reform actions around building blocks (e.g., governance arrangements, coordination among government policies) and developing strategies to monitor and mitigate specific fiscal risks. Based on these strategies, countries can develop various policy measures that take into account the direct, contingent, explicit, and implicit nature of the exposure (e.g., whether to issue guarantees to state-owned enterprises instead of being exposed to the implicit contingent liabilities from them).

- Technical assistance tailored to individual fiscal risks: For each fiscal risk arising from debt-related liability, risk-management strategies are developed to implement tools to mitigate and monitor risks. Such tools help to raise awareness about risks (e.g., risk disclosure and accounting); mitigate risks (e.g., through financial hedges, and insurance); and increase preparedness in case risks materialize (e.g., through fee revenues; contingency funds; and budgeting). The set of analytical tools used to monitor these risks includes:

A Framework for Managing Government Guarantees, which helps governments develop sound governance arrangements, establish the institutional and technical setup to evaluate the contingent liabilities from guarantees, and build tools to manage and monitor credit risk arising from guarantees. This framework and accompanying analytical tools also help address the implicit risks from state-owned enterprises (SOEs), public corporations, and subnational entities.

The Credit Rating Stylized Analytical Tool supports the evaluation of the credit risk that accrues to a central government when a public corporation’s non-performance of its financial obligations results in a cost to that government. The tool and the accompanying guidance note help the user undertake fundamental risk analysis of public corporations.

The Public-Private Partnerships Fiscal Risk Assessment (PFRAM) Model, developed by the IMF and the World Bank Group, is an analytical tool to assess fiscal costs and risks arising from public-private partnership (PPP) projects. It is designed to assist governments in assessing fiscal implications of PPPs, as well as in managing these projects in a proactive manner. PFRAM has been used by the World Bank's infrastructure and macroeconomics teams to advise governments on the medium- to long-term fiscal implications of PPPs and can be used for an individual project or a set of projects.

A stochastic fiscal sustainability assessment, which incorporates the effects of uncertainty into the standard debt sustainability analysis and aggregates the fiscal risks in a probabilistic and endogenous analytical framework.