Source: WDR 2022 team. Data from World Bank, World Development Indicators (dashboard), https://datatopics.worldbank.org/world-development-indicators/; International Monetary Fund, World Economic Outlook Database: Download WEO Data, April 2021 Edition (dashboard), https://www.imf.org/en/Publications/WEO/weo-database/2021/April. Note: The figure shows the general government debt stock as a share of gross domestic product (GDP) by World Bank income classification. |

The resulting buildup of sovereign debt poses significant risks to the worldwide economic recovery. Overindebted governments are unable to pay for public goods such as education and public health care, thereby risking poorer human development outcomes and abrupt increases in inequality.2 Countries in debt distress also have limited capacity to cope with future shocks and may be unable to serve as the lender of last resort to private sector companies in need of public assistance.3

The systemic debt crisis that significantly affected emerging economies in the 1980s illustrates the dire economic and social consequences arising from delayed policy action to mitigate the risks of escalating sovereign debt.4 Many countries in Latin America and Sub-Saharan Africa suffered a lost decade of development: inflation surged, currencies crashed, output collapsed, incomes plummeted, and poverty and inequality increased across regions. The 41 countries that defaulted on their government debt between 1980 and 1985 needed an average of eight years to reach precrisis GDP per capita levels. In the 20 countries with the worst output drops, the economic and social fallout from the debt crisis continued for more than a decade.

The experience of these countries underscores the importance of urgent action to prevent a prolonged debt crisis in the wake of COVID-19. The solution? Countries must manage unsustainable sovereign debt promptly and proactively to minimize its economic and social costs and enable public spending to fuel an equitable economic recovery. The approach depends on the severity of the debt challenges—that is, the stage at which the problem is. The elements of the approach would include the following.

Managing sovereign debt to free up resources for recovery

In countries at high risk of debt distress, proactive debt management can reduce the likelihood of default and free up resources to support economic recovery. Broadly, there are two options for debt management: (1) debt reprofiling—that is, modifications of the aggregate schedule of future country repayments through refinancing, debt substitution, or renegotiations; or (2) debt restructuring—that is, modifications of the financial structure of liabilities to reduce their net present value.

A reprofiling operation could be helpful if a country has multiple loans that come due in the same year or other kinds of accumulation in exposure, such as in the currency composition of liabilities. The sovereign could issue new debt with a longer or more even maturity profile. Debt reprofiling can also help address currency risk, which often adds to debt sustainability concerns. In such circumstances, instead of changing the maturity of existing debt, the debt reprofiling operation would retire existing debt denominated in one currency and issue new debt in another currency.

Sovereigns facing rising default risk also have the option of initiating preemptive negotiations with their creditors to reach a debt restructuring. This option requires transparency in the terms and ownership of the debt. Evidence indicates that preemptive restructurings are resolved more quickly than postdefault restructuring, lead to shorter exclusion periods from global capital markets, and are associated with a smaller output losses.5 In these situations, it is important to minimize the chances that an individual creditor holds out to reap benefit from the operation.

Resolving debt distress

Once a government is in debt distress, the options available for confronting the problem are more limited. A primary tool at this stage is debt restructuring, coupled with a medium-term fiscal and economic reform plan. Optimizing the use of this tool requires prompt recognition of the extent of the problem, coordination with and among creditors, and an understanding by all parties that restructuring is the first step toward debt sustainability—not the last. International financial institutions such as the International Monetary Fund and World Bank often play an important role in the debt restructuring process in emerging economies. They conduct the debt sustainability analyses needed to understand the problem fully, and they often provide financing to make the deal viable.

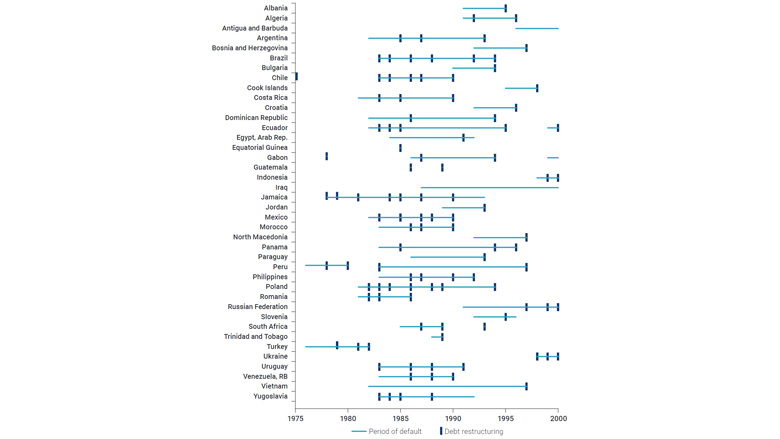

A swift and deep restructuring agreement allows a more rapid and sustained recovery.6 The historical track record, however, reveals that resolution of sovereign debt distress is often delayed for years. Even if countries enter negotiations with creditors, they often require multiple rounds of debt restructuring to emerge from debt distress (figure 5.2). Nigeria and Poland, for example, each underwent seven debt restructuring deals before finally resolving their unsustainable debt.

Figure 5.2. Sovereign debt restructuring and time spent in default, selected countries, 1975–2000