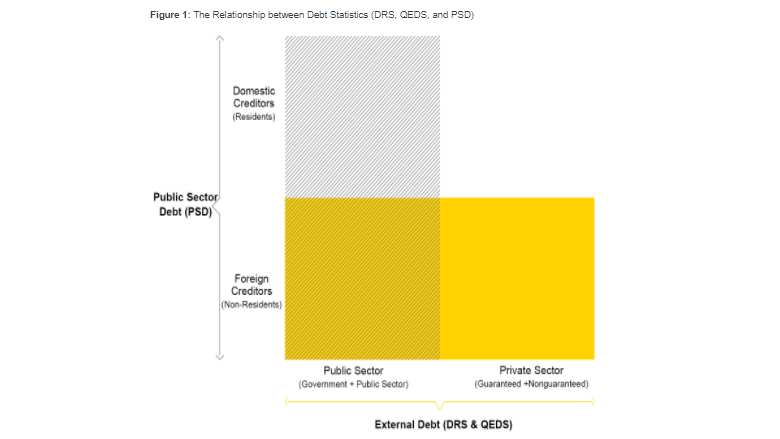

The objective of the Online Quarterly Bulletin is to showcase the debt statistics data and the availability of high frequency data on external and domestic debt. The Bulletin serves as a vehicle for providing users with regular updates on trends in external and public sector borrowing by developing and high income countries, as well as showcasing innovations in data capture and presentation. The Online Quarterly Bulletin is divided into three sections. The first section is a feature story that highlights a topical aspect of monitoring and managing debt statistics. The second section provides analysis and trends of the debt statistics, using graphs to highlight the main messages. The third section is used to provide information on key activities related to debt statistics. This edition of the bulletin familiarizes users with the extensive coverage and content of the debt data that the Bank makes available and the links between data reported to the Quarterly External Debt Statistics (QEDS) and the Public Sector Debt (PSD) and that collected through the World Bank Debt Reporting System (DRS) and published in International Debt Statistics (IDS).

Where can you find debt statistics?

For nearly half a century policymakers, academics, and journalists have relied on external debt statistics collected through the World Bank Debt Reporting System (DRS) and published annually in the International Debt Statistics (IDS) publication, and its predecessor World Debt Tables, to identify financial trends and vulnerabilities. The DRS captures data for low- and middle-income countries.Reporting to the DRS is mandatory for all countries that borrowing from the World Bank (IBRD or IDA). Not so widely appreciated is the fact that this annual data is complemented by high frequency quarterly external and public debt statistics captured through the Quarterly External Debt Statistics (QEDS) and the Public Sector Debt (PSD). QEDS and PSD include data for high-income and low- and middle-income countries. Reporting to these systems is actively encouraged and more than 130 countries participate on a voluntary basis. In addition to the information published in IDS extensive compilations drawn from the DRS data are also available through the World Bank Open Data website.