It seemed like the start of a new financial contagion in emerging markets.

In September 2015, the currencies of a wide range of emerging-market economies nosedived on fears that Chinese economic growth might slow, and that the U.S. central bank might begin to raise interest rates. The Brazilian real, the Turkish lira, and the South African rand sank to record lows. “It’s carnage out there for emerging markets,” one headline read.

Colombia, however, came through unscathed. Its economy grew 3.1 percent that year, one of the highest rates in the region, as poverty and income inequality receded. It had weathered the storm by putting in place what the International Monetary Fund called a “strong policy framework” and a “coordinated and proactive policy response.” An important component of this was the layer of defenses it had established on public debt and risk management, with the support of a group of international partners.

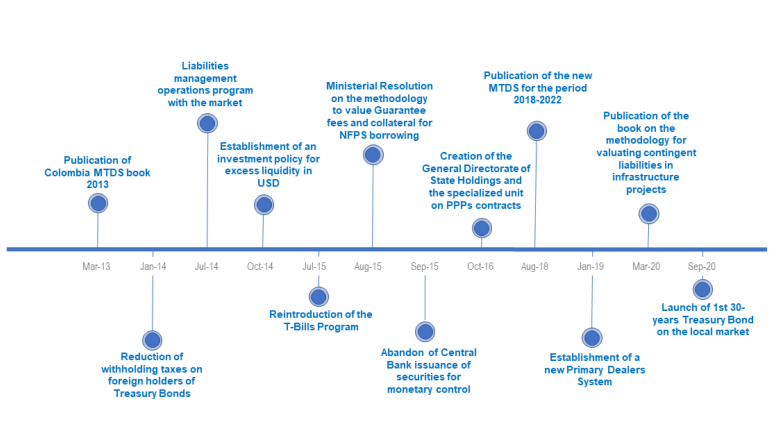

In 2011, just four years before, Colombia had partnered with the Government Debt and Risk Management Program, a World Bank initiative sponsored by the Swiss State Secretariat for Economic Affairs (SECO). Since then, Colombia has steadily improved its debt-management strategy as well as its borrowing operations, governance, institutional arrangements, and coordination on fiscal and monetary policies.

in at least five important areas:

1) Developing a debt management strategy

Two years into the GDRM partnership, Colombia published a formal medium-term debt management strategy. This was a direct result of GDRM technical advisory work to enhance Colombia’s analytical model for evaluating the costs and risks of alternative financing options. The strategy focused primarily on developing domestic sources of financing and proved to be fundamental in building resilience, as evidenced during the emerging markets turmoil experimented in 2015.

The debt strategy was later revamped for the 2018-22 period, featuring improvements such as optimizing the country’s debt-issuance policy through different currencies, rates, and terms. These improvements have enabled Colombia to expand to other markets—including the Euro market—to better diversify the currency risk of its debt portfolio. The updated approach includes stronger coordination with Colombia’s General Directorate of Macroeconomic Policy. It also takes Colombia’s balance sheet into account by considering oil export revenues as well as foreign-currency debt issuances in the underlying analyses. For the first time, the revised strategy guides the country’s Annual Borrowing Plan.

Colombia also strengthened its communication with market participants by creating a website dedicated to investor relations and by holding regular meetings with primary dealers of government securities.