KIGALI, July 15, 2015 – A strong, diversified financial sector can help the government gradually transition from aid, finance its development and benefit a larger group of Rwandans, according to a new report from the World Bank Group.

The eighth edition of the Rwanda Economic Update, Financing Development: The Role of a Deeper and More Diversified Financial Sector, explores options for how the financial sector can develop an efficient, sound, and inclusive financial sector to help the government achieve its development vision and the benefits from a well-managed, broad-based financial sector can benefit more Rwandans.

“Despite recent international and domestic economic developments in Rwanda the Bank’s growth projection is optimistic at 7.4 percent in 2015 and 7.6 percent in 2016,” says Yoichiro Ishihara, World Bank senior economist. “Developing a stable, sound and efficient financial sector will contribute to the government’s goal to transform the country into a middle-income country by 2020.”

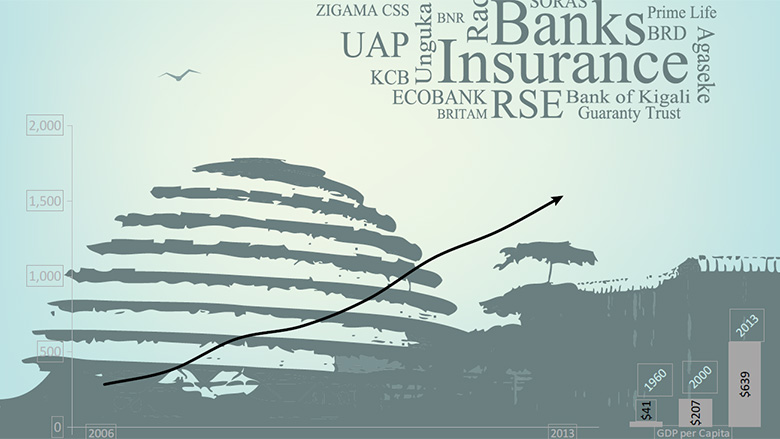

After successfully weathering a drop in aid financing in 2012, Rwanda’s economy surpassed expectations with a jump in the Gross Domestic Product (GDP) from 4.7% in 2013 to 7.0% in 2014. The country’s financial sector has made great strides towards modernizing, yet limited access to external investments and anemic exports threaten to undermine progress.

The report’s recommendation to develop a sound, stable and diverse financial sector to support the country’s development comes on the heels of recent domestic budget issues that offer mixed signals on Rwanda’s future economic direction. Internal financial issues such as low tax to GDP ratio, a significant reliance on declining foreign aid, and a deterioration in current account deficits (from 7.4% of GDP in 2013 to 11.8% in 2014) dampen the country’s forward moving economy.

The government has invested in economic development but has not developed vibrant tradable sectors such as export crops, manufacturing and mining. The combination of high public investment and low export revenues has increased reliance on foreign financing, mainly in aid. Steps to diversify and strengthen the country’s financial investments and institutions will stabilize Rwanda’s positive economic growth, and help ensure the poverty rate continues to decrease as expected, to 54% in 2016, down from 63% in 2011.

“A stable financial sector provides a foundation for the achievement of all of the government’s strategic objectives, including in social development and governance,” says Carolyn Turk, World Bank’s Country Manager for Rwanda. “The steps in this economic update can accelerate the development of the financial sector in Rwanda, which is essential in financing development and for maintaining the economy’s strong expansion.”

To help Rwanda accelerate the development of an efficient, strong and inclusive financial sector the update makes several recommendations:

- Expand into an integrated regional market to achieve a larger scale to improve the ability of regional firms to access capital markets for long-term financing needs. As part of this effort, Rwanda and Kenya have recently connected their stock markets electronically.

- Support institutions to facilitate domestic and foreign debt financing, including through bond issuance, and accessing international capital markets.

- Encourage institutional investors, such as pension and insurance funds, to invest in long-term projects. The most important source of such long-term financing in Rwanda is the Rwanda Social Security Board.

- Strengthen the ability of banks to include the currently unbanked into the banking system, to support inclusion and ultimately realize the benefits of economies of scale.

- Carefully weigh the benefits against the costs of borrowing, while allowing for the exchange rate risk that comes with borrowing in foreign currency.