September 11 - September 15, 2023

Municipalities need a stable revenue base to support the rapid pace of urbanization.

Cities are under pressure. Ongoing pressures from rapid urbanization, population growth, more demand for services, and climatic impacts, in conjunction with the current “build back better” trend of the post-COVID-19 era, are pushing cities to create more environmentally friendly, resilient, inclusive, and safe urban environments—and at great expense.

With cities facing such challenges, participants attending the Tokyo Development Learning Center's (TDLC) Technical Deep Dive (TDD) in Tokyo and Yokohama, Japan, sought answers to how a stable revenue stream could be secured to support the pace of urbanization and its demands on infrastructure and public services. It is evident that cities today must find new and innovative ways to secure constant revenue streams by improving the performance of their tax systems and leveraging their underutilized assets and policy instruments. Two emerging solutions at the disposal of municipal governments are property taxes and land-based financing tools.

Reevaluating Property Taxes and Land-based Financing

Property taxation is a widely used method for generating revenue by local governments worldwide. It is a generally dependable and predictable source of income for financing infrastructure projects and providing public services in countries like the United States and Japan. However, this is not the case for many developing countries. For these, significant challenges in land valuation, tax calculation, and tax collection are common. A growing movement is helping to identify improved methods for valuing, calculating, and collecting property taxes in developing countries. Additionally, commonly used forms of land-based financing – sales of development rights, impact fees, special assessment districts and land pooling – require certain building blocks to be in place before these tools can be used. Without these underpinnings, many developing countries are missing out on opportunities to generate additional revenue and catalyze broader economic impact through these tools.

Property Tax and Land-based Financing TDD

TDLC, in collaboration with the City Management and Governance Global Solutions Group (GSG) and the Urban Regeneration and Land Value Capture Knowledge Silo Breakers (KSB), launched its FY24 TDD series by hosting a five-day, in-person TDD to discuss challenges and solutions around incorporating land-based financing and property tax policies and practices. Held in Tokyo and Yokohama City, Japan, from September 11–15, 36 participants from eight countries, Brazil, Ethiopia, Ghana, Indonesia, North Macedonia, Pakistan, Philippines, and Tanzania, as well as global experts and practitioners from Japan, the United States, South Africa, and South Korea joined the event to share their wealth of knowledge and experiences related to property taxation and land-based financing.

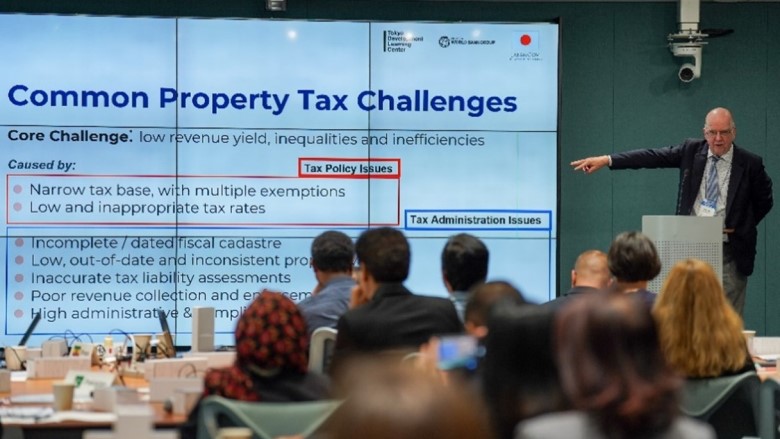

Participants gained a better understanding of property taxes through presentations by experts such as Dr. Roy Kelly, Professor Emeritus at Duke University. Dr. Kelly explained that property taxes are a stable and easy-to-administer source of revenue for local governments, able to extract land use values and be sensitive to taxpayers' ability to pay. He also noted the importance of having a design and implementation strategy in place for property tax calculation and collection to help avoid political hurdles that could make it difficult to utilize these tools.

Land-based financing discussions focused on development rights, special assessment districts, public real estate management, and land readjustment. Public-private partnerships (PPPs) were also among the important topics of discussions as many land-based financing projects are PPPs. Conducting market research, determining the trustworthiness of private companies, developing legal systems and enabling environments for private sector participation and enhancing stakeholder dialogue were also emphasized.