WASHINGTON, June 28, 2016—Did you know that 94% of shipments imported into Germany meet the quality standards of global logistics operators, compared to only 40% in Bolivia? Or that importing goods into Georgia requires traders to deal with just one agency, but in Madagascar, traders must deal with 10?

All of these issues, and more, are captured under the broad category of logistics – the methods and procedures a country uses to move goods across borders. Infrastructure, procedures, regulations, geographic characteristics and even political economy issues all play a role in defining the strength of a country’s logistics.

Global trade depends on logistics, and how efficiently countries import and export goods defines how they grow and compete in the global economy. Countries with efficient logistics can easily connect firms to domestic and international markets through reliable supply chains. Countries with inefficient logistics face high costs – both in terms of time and money – in international trade and global supply chains. This can severely hamper a nation’s ability to compete globally.

“There is no trade without logistics and poor logistics often means poor trade,” said Huxiang Zhao, President of the International Federation of Freight Forwarders Association. “Logistics performance requires the integration of many elements throughout the entire supply chain.”

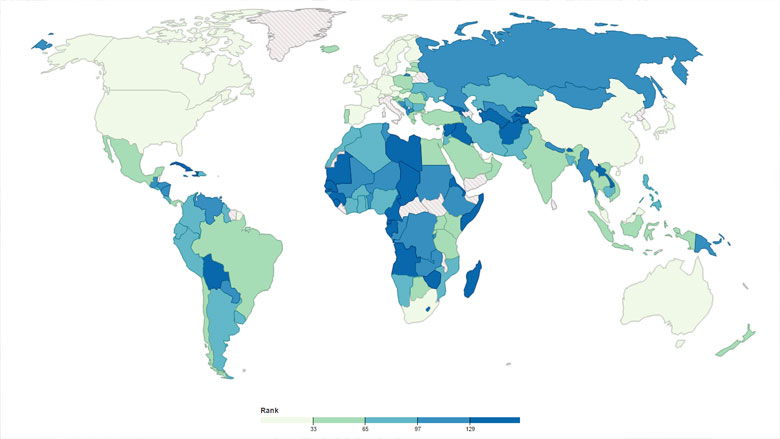

With so many factors involved in a country’s logistics, it can be difficult to conduct comparisons across countries. This is why the latest issue of the World Bank Group’s bi-annual report Connecting to Compete 2016: Trade Logistics in the Global Economy includes The Logistics Performance Index (LPI), which captures critical information about the complexity of international trade. The index scores countries on key criteria of logistics performance, including border clearance efficiency, infrastructure quality, and timeliness of shipments, among others. For the second time in a row, Germany is the top performer, while Syria ranked last.

“Looking back across past editions of the LPI, we have been able to demonstrate to policymakers that logistics matter to all countries, regardless of income level,” notes Jean-François Arvis, Lead Specialist for Trade & Competitiveness at the World Bank Group and co-author of the report. “Today, logistics are increasingly complex as they incorporate more areas such as green logistics, jobs, or city distribution.”

The scores are based on two sources of information: a worldwide survey of logistics professionals operating on the ground (such as global freight forwarders and express carriers), who provide feedback on the countries in which they operate and with whom they trade; and quantitative data on the performance of key components of the supply chain, such as the time, cost, and required procedures to import and export goods.