What is holding developing country cities back from accessing the financing they need for sustainable urban development?

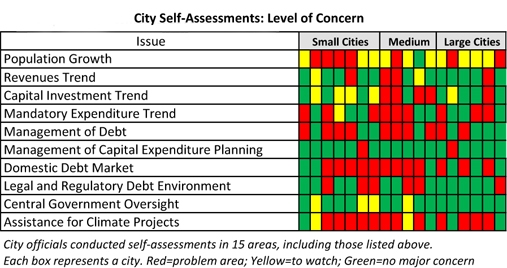

At the first City Creditworthiness Academy workshop organized by the World Bank and partners in Nairobi last October, 18 cities in Africa conducted a self-assessment of their finances, shedding light on a common concern – the need to develop local capital markets.

“My city is on the brink of exploding in terms of population, which comes with the challenge of providing infrastructure and facilities. We will need extra finance,” said Ebenezer A. Kwaitoo, municipal solicitor from Sekondi-Takoradi Metropolitan Assembly, Ghana. “We didn’t have the facilities to rate ourselves so far as credit is concerned, but this workshop has opened our eyes to what we need to do, to be able to attract investment to support our projects.”

In the assessment, the infancy of capital markets and the inadequate creditworthiness of municipalities emerged as clear priorities for action: 12 cities claimed no access to long-term financing from debt markets, and only two cities had a credit rating at a local or international scale.

Why Local Capital Markets Matter

Without local capital markets, most municipalities in developing countries would have no option to finance debt. That is because tapping international markets requires borrowers to meet even higher creditworthiness standards, and higher transaction costs for both investors and borrowers imply volumes of financing that are likely to exceed the debt capacity of municipalities. Most importantly, only local currency debt financing is appropriate for municipal-level infrastructure that does not generate hard currency revenues.

Most emerging markets have a well-established banking sector, but local commercial banks usually find it difficult to provide loans that match the long-term nature of infrastructure projects. Also, capital investments often require funding that exceeds the amount that a commercial bank can lend to a single customer under banking regulations. Supporting the development of mature local capital markets can help address these constraints.