Global Wealth: Top Findings

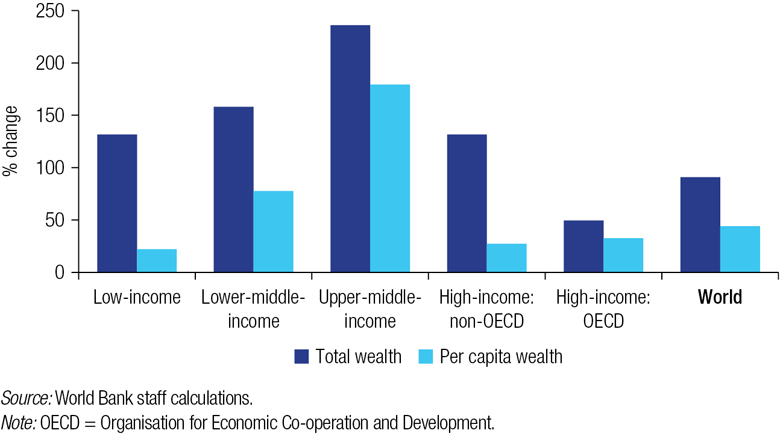

There is some good news—global wealth grew significantly between 1995 and 2018 and middle-income countries are catching up to high-income countries, mainly due to rapid growth in Asia. Upper-middle-income countries saw their total wealth more than double over this period.

Growth of Total Wealth per Capita, 1995–2018

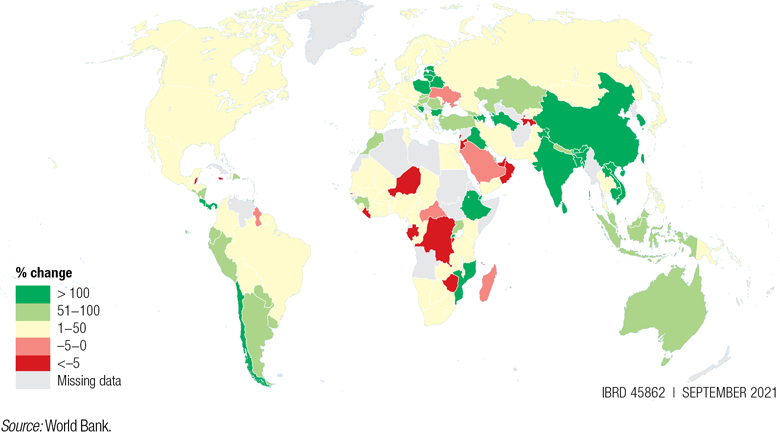

However, a closer look at the wealth accounts paints a more concerning picture. Unfortunately, inequality between countries persists. Between 1995 and 2018, low-income countries’ share of global wealth hardly changed, remaining below 1 percent despite being home to about 8 percent of the world’s population. When looking at wealth per capita, a good indicator of sustainability, trends are also troubling. In 26 countries, wealth per capita actually declined between 1995 and 2018, and almost half of these were in Sub-Saharan Africa.

Although wealth is growing globally, in some countries this may be at the expense of future prosperity. Where wealth in some asset categories is falling despite rising GDP, growth may be unsustainable. Declining wealth per capita breaks a core principle of sustainability: that future generations be left no worse off than current generations.

Changes in Total Wealth and per Capita Wealth, 1995–2018

Renewable Natural Capital

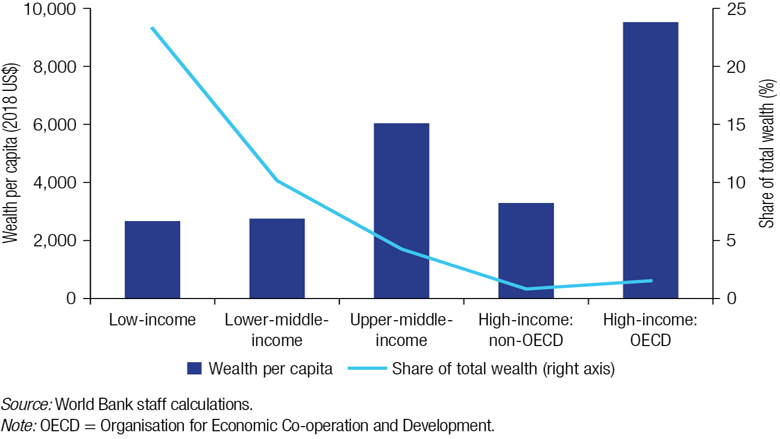

Renewable natural capital, such as forests, cropland, and ocean resources, forms a very large share of wealth for low-income countries. This type of capital provides critical ecosystem services that underpin livelihoods and economies. This means that it is of even greater importance for sustainable socioeconomic development and poverty reduction to manage this wealth carefully and not deplete natural assets for a short-term income boost.

Although in terms of value, wealth in renewable natural capital is growing, its share of total wealth is decreasing and being further threatened by climate change. Among low- and middle-income countries forest wealth per capita has declined 8 percent from 1995 to 2018 largely due to degradation and agricultural conversion. Globally, the value of fish stocks collapsed by 83 percent due to poor management and overfishing. However, mangrove flood protection services have grown more than 2.5 times in value to over $547 billion. The value of protected areas has also rapidly increased. Investments in these types of natural capital could help countries increase their resilience and build future wealth.

Although renewable energy is not yet valued in this edition of the report, water, wind, and solar energy represent a potentially large wealth of nations. Better climate and energy policies, for example pricing carbon emissions, could quickly unlock significant value of renewable energy assets.

Renewable Natural Capital: Wealth per Capita Value in 2018 versus Share of Total Wealth Nonrenewable Natural Capital

Countries with a disproportionate share of wealth coming from individual assets, particularly subsoil resources such as oil, gas, and minerals, have faced volatile and even declining wealth, mainly due to falling commodity prices. Historically, environmentally harmful forms of capital, like carbon-emitting fossil fuels, are often overvalued, creating market incentives to over-invest in these assets. The low-carbon transition poses economic risks to countries that are overly dependent on nonrenewable capital, particularly fossil fuels, and increases the importance of asset diversification. The report finds that the low-carbon transition could lower the global value of fossil fuel assets by US$4.4 trillion to US$6.2 trillion (by 13 - 18 percent) between 2018 and 2050. Countries can manage this risk by reinvesting wealth from fossil fuels into the other types of wealth – for example, human capital - away from fossil fuel value chains.

Human Capital

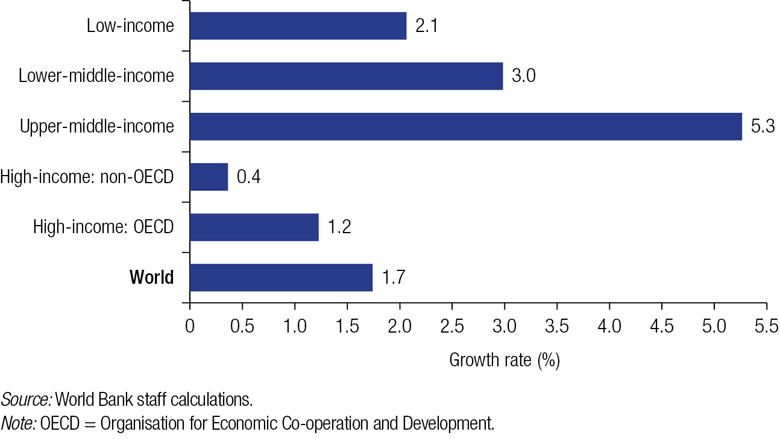

Human capital, estimated as the expected lifetime earnings of the population, is the largest source of worldwide wealth, comprising 64 percent of total global wealth in 2018. Middle income countries have increased their investment in human capital and in turn saw significant increases in their share of global human capital wealth. Human capital generally makes up a greater share of wealth as countries reach higher levels of economic development, with the exception of high-income countries that are dependent on fossil fuel wealth, which have the lowest share of human capital. However, total human capital is constrained by gender gaps. Little progress has been made toward greater gender parity over the past 25 years. Globally, women accounted for only 37 percent of human capital in 2018, only 2 percentage points greater than in 1995. Women account for less than 40 percent of human capital at all levels of development.

Annual Growth Rate of Human Capital per Capita, 1995–2018 Pollution of outdoor and indoor air is also constraining the potential of human capital. If there were no premature deaths from air pollution, global human capital would have been about 0.3 percent higher in 2018.

Although the long-term impacts of the COVID-19 pandemic remain to be seen, low-income countries are expected to experience the most severe impacts, with a loss of 14 percent of their total human capital compared to 2018. As a share of human capital, Sub-Saharan Africa and South Asia are expected to suffer the greatest setbacks.