Plastics are an integral and important part of the Thai economy. Its petrochemical sector is the largest in Southeast Asia and the 16th largest in the world, producing 11.8 million tonnes of downstream products — including plastic resins — in 2018. Thailand’s plastics industry contributed US$36.9 billion to the national economy in 2018 (6.71% of GDP).

But mismanaged plastic waste has serious economic and environmental consequences. Asia is responsible for over 80% of plastic leakage into marine environments, and 8 of the top 10 contributing countries are from this region — with Thailand ranking sixth globally, according to some estimates.

This study uses a plastic value chain approach to evaluate Thailand’s plastics recycling industry and its role in supporting a circular economy. It identifies major challenges, market drivers and opportunities for scaling-up recycling efforts via targeted public and private sector interventions.

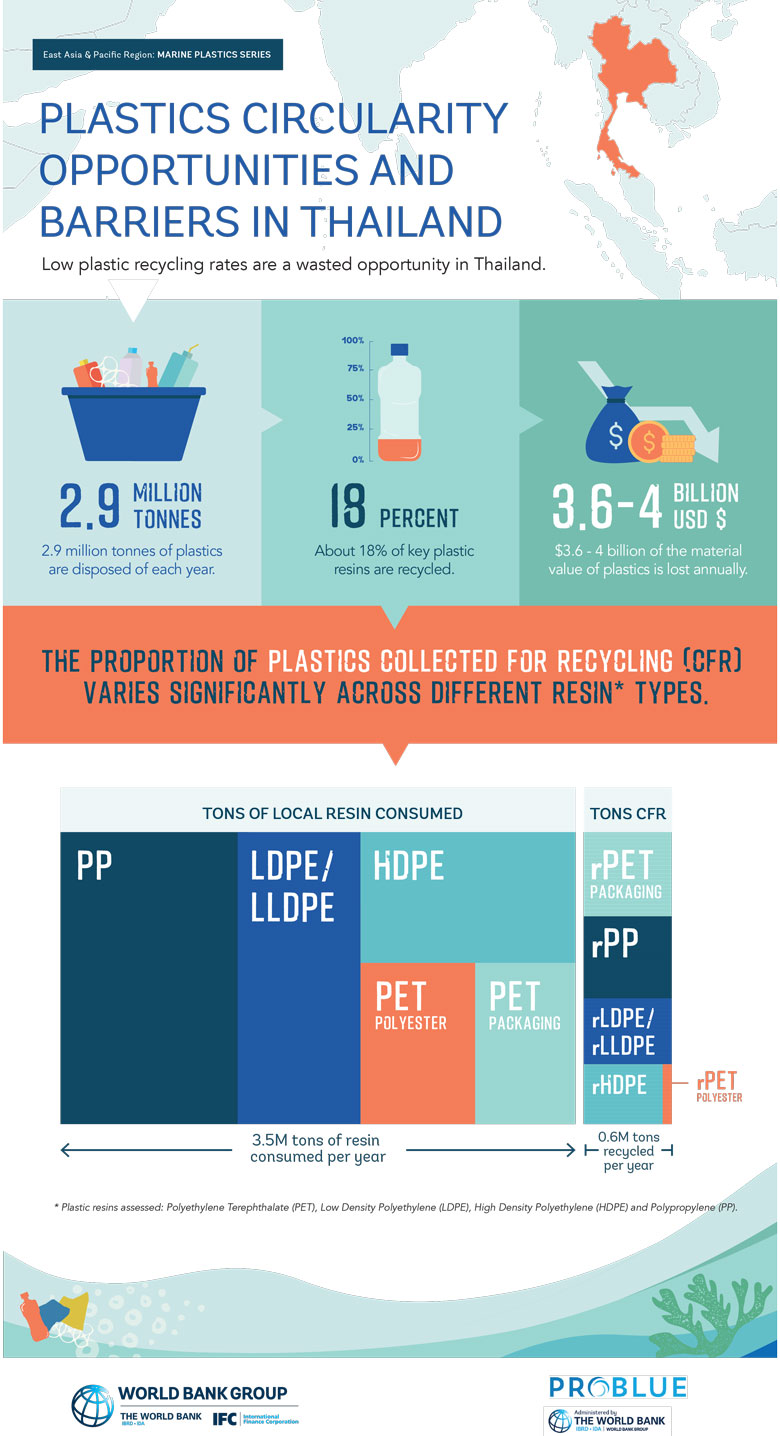

The key plastic resins assessed in this study are: Polyethylene Terephthalate (PET), Low Density Polyethylene (LDPE), High Density Polyethylene (HDPE) and Polypropylene (PP).

Key findings

Thailand recycled just 17.6% of key plastic resins in 2018, falling short of the National Plastic Waste Management Roadmap 2018-2030 target of 22%.

when 2.88 million tonnes are discarded rather than recycled into valuable materials.

Several structural challenges cause a market failure for plastics recycling:

- Lack of Extended Producer Responsibility (EPR) for industries that produce and import plastic packaging

- Limited local demand for recycled plastics, despite voluntary brand commitments

- Linear municipal waste systems that prioritize waste collection over recycling

- Different sets of fiscal incentives for the recycling industry compared to the virgin plastics industry

Other factors that exacerbate the market failure for plastics recycling include:

- Exposure of the recycling industry to oil and virgin plastic price drops

- Inability to capitalize on demand for high-value food-grade packaging with recycled content

- Import restrictions on high-quality, recyclable scrap plastics

- Limited internalization of plastic waste mismanagement costs among plastic producers

Many of these challenges are amplified by the ongoing COVID-19 pandemic. Changes in consumption patterns and low waste collection rates have led to supply reductions in the recycling industry, while low oil prices and economic slowdown have made it cheaper to use virgin rather than recycled plastic.

Key interventions and actions

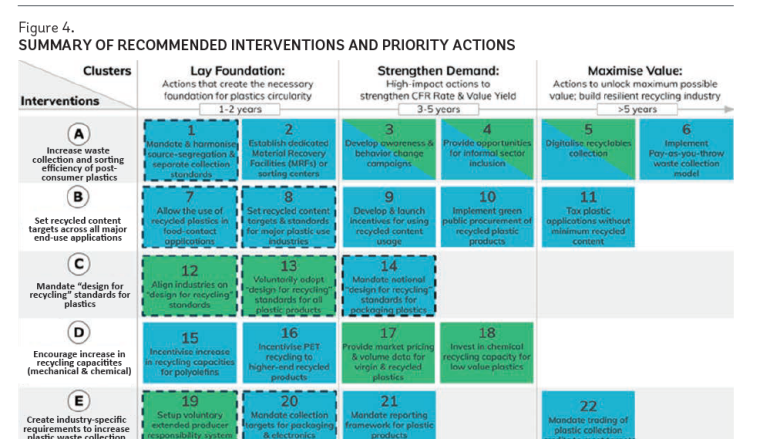

- Increase waste sorting efficiency.

- Set recycled content targets across all major end-use applications.

- Mandate “design for recycling” standards for plastics.

- Support increase in recycling capacities (mechanical and chemical).

- Create industry-specific requirements to collect post-consumer use products.

- Restrict disposal of recyclable plastics and illegal dumping.

RECOMMENDED INTERVENTIONS AND ACTIONS