CHALLENGES

A key challenge is the risk that healthy businesses will fail and the remaining firms will produce less than before the crisis.

The unprecedented scale of the COVID-19 pandemic creates a significant risk of business failures and more permanently scaled-back production, thereby transforming an immediate crisis into a long-term distorted equilibrium of productivity, labor markets, and growth potential.

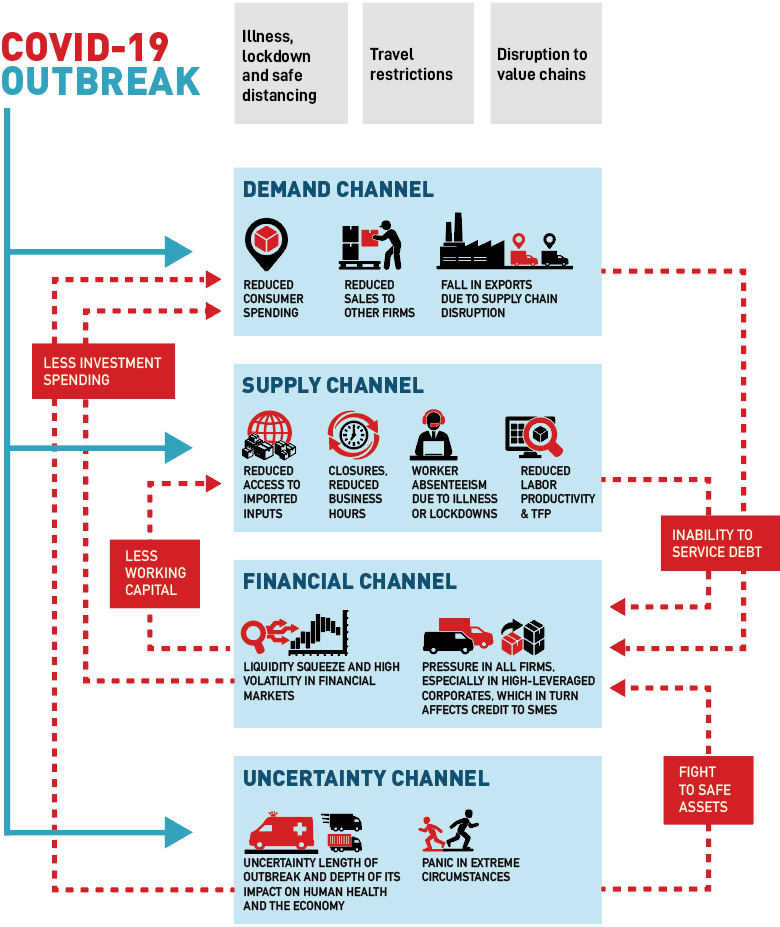

The COVID-19 crisis affects firms through four different, but mutually reinforcing, channels: demand, supply, finance, and uncertainty.

Unlike a standard demand shock, the pandemic has led to reductions in consumer spending on goods and services, sales to other firms, and exports due to disruptions in supply chains. On the supply side, it has resulted in reduced access to imported inputs, business closures, shorter business hours, lockdowns and worker absenteeism due to illness or quarantines, and overall reduced labor and total factor productivity.

Financial channels are under stress because of the liquidity squeeze and high volatility and pressure in all firms, especially in highly leveraged corporates, which in turn affects credit to small and medium enterprises (SMEs). Compounding these trends is the general panic caused by extreme circumstances, including uncertainty about the length of the outbreak and the depth of its impact on human health and the economy.

WHAT RUSSIA HAS DONE TO CONFRONT THESE CHALLENGES

Anti-crisis measures to support affected sectors, regions, SMEs, and large companies

Russia started responding to the COVID-19 outbreak at the end of January 2020. The government’s anti-crisis measures announced to date amount to roughly RUB 1.4 trillion, or approximately 1.2 percent of GDP, a figure smaller than that for many OECD countries, where stimulus measures exceed 10 percent of GDP. The specific economic support measures introduced by the federal and regional governments and the Central Bank of Russia (CBR) largely match those introduced in other countries, with certain instruments aimed at regional budgets, SMEs, affected sectors, and large, systemically important companies.

Macro-fiscal and monetary measures

Macro-fiscal and monetary measures include regulatory forbearance as well as additional actions to ensure the availability of payments systems and protect retail borrowers suffering from the pandemic. The CBR has introduced a new RUB 500 billion facility for SME lending and reduced the interest rate on the existing RUB 175 billion facility. Measures aimed at households allow for the restructuring of bank loans.

WHAT ARE OTHER COUNTRIES DOING?

As of mid-April 2020, the World Bank had catalogued 723 policy measures implemented in 113 countries to support firms in response to the COVID-19 crisis.

Two-thirds of these measures are dedicated to access to finance through new lending at concessional terms, payment deferrals, credit guarantees, and employment support in the form of wage subsidies and transfers to the self-employed. An additional 15 percent of the support measures involve different forms of tax deferrals.

The market-specific measures in both high-income and developing countries continue to focus on the tourism and transport sectors, particularly aviation, followed by other services.

In the digital sector, measures are focusing on digital adoption and digital payments. In manufacturing, actions are targeting the medical equipment and pharmaceutical subsectors. In services, the subsectors that have received the most support outside of tourism include transport, private health care, and construction, the latter related mainly to health care infrastructure.

The most commonly used instruments involve support for debt finance, employment (excluding unemployment and worker-specific measures), and taxation.

Policy measures were divided in 11 categories: debt finance, business costs, demands, production, tax, employment support, business climate, business advice, regulation, business upgrading, and other finance.

Last Updated: May 04, 2020

WHAT MORE COULD BE DONE?

To avoid the pandemic’s negative effects on economies and workers, it is critical that governments provide support to viable firms and that financial institutions continue to provide access to credit and working capital for businesses in a sustainable way.

Focus on the immediate efforts needed to contain and assess the damage

- Protection of the poorest and the most vulnerable

- Maintenance of access to finance

- Support to jobs and firms

- Short-term relief measures complemented with intermediate-term policies to accelerate the recovery, especially as countries move beyond the peak of the health crisis and further into the economic crisis

Enhance the use of financial digital payments

- FinTech solutions could be leveraged to improve MSMEs’ access to financing, offering an unprecedented opportunity to mitigate the impact of the crisis.

- Simplified loan application processes, customer due diligence (CDD), remote Know Your Customer (eKYC) rules, and the use of alternative data for credit decisions could be implemented.

- Financial institutions could leverage online platforms and capital market solutions to conduct reverse-factoring transactions that could facilitate supply-chain finance and shorten the maturity of payments involved.

Ensure that the financial sector has the capacity to provide the needed liquidity and support without jeopardizing its resilience

- Many financial sector regulators may decide to take unprecedented regulatory forbearance decisions. These will need to be designed carefully to avoid increasing the financial risk. This calls for the adequate reporting and monitoring of forbearance measures to be able to assess asset quality, provisioning, and capital adequacy on a continuous basis, with decisions that are time-bound, transparent, and based on rigorous risk assessments.

Use data and analysis to inform and improve support programs

- Global experience with immediate crisis response measures has shown that there are challenges in ensuring that support reaches the appropriate firms, such as cumbersome loan applications and bureaucratic hassles.

- Tax data, surveys, and other reporting can be used to understand firm viability and customize support to match specific needs in different industries.

- Specific support measures should be carefully targeted and regularly reviewed to ensure that they continue to meet the intended purposes.

RISKS AND PITFALLS TO AVOID

There are risks inherent in any crisis response, given both the urgency and scope of the action needed. Building on lessons learned from previous economic shocks, including the 2008 global financial crisis, two particular issues should be noted:

Efforts need to refocus on supporting growth-oriented enterprises (including start-ups), restructuring firms, and avoiding measures that risk propping up zombie firms.

Most current scenarios assume that the recovery phase will extend for 18 months after the outbreak is contained, and during this period many firms, including both larger corporates and SMEs, will face the risk of insolvency. Scarce resources to support firms should be prioritized on those businesses that demonstrated pre-crisis viability (as confirmed by the 2019 or latest available balance sheet information) to avoid propping up failing firms at the expense of more productive enterprises. This will help accelerate the recovery period and minimize long-term economic distortions.

Policies should be explicit on how losses will be socialized.

As the crisis persists and liquidity constraints become solvency problems, it will be important to be transparent and clear on how the losses will be socialized. On the economic side, a shock like the COVID-19 pandemic was essentially uninsurable, and it will affect individual firms and households in radically different ways. In this context, only the government can serve as an insurer of last resort. Furthermore, the shock and the response could spread costs around the economy or across generations in a non-transparent manner. The socialization of the losses is bound to involve transfers and bailouts. This process needs to be perceived as fair if countries are to maintain social cohesion.

Last Updated: May 05, 2020

MULTIMEDIA

Expert Answers: How Can We Help Countries Dealing with Coronavirus?

Experts

Renaud Seligmann

Director for Strategy and Operations, Planet Vice Presidency