Key Findings

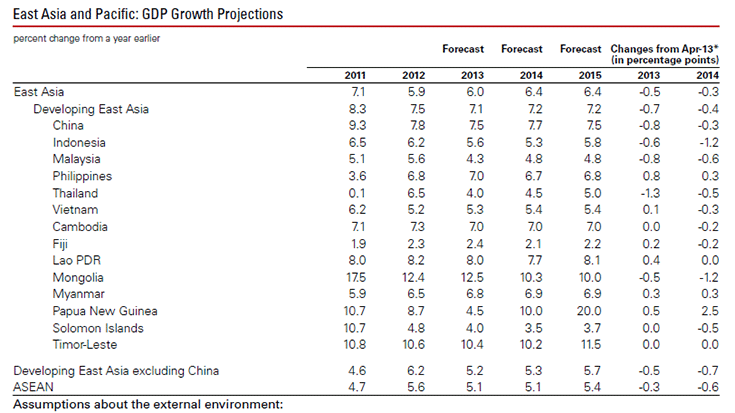

- The economies of developing East Asia and Pacific are projected to grow at 7.1 percent in 2013, down from 7.5 percent last year.

- While the pace of growth is slowing, the region will still contribute 40 percent of global growth and one-third of global trade this year—higher than any other region in the world.

- In China, growth is moderating as the country rebalances to pursue a more sustainable growth path. In 2013, it is expected to meet the official indicative growth target of 7.5 percent.

- This is considerably lower than the 8.3 percent we projected earlier, primarily because the most recent expansion in credit has been less effective in generating growth.

- In the medium term, China’s growth is expected to remain between 7.5 and 7.7 percent.

- Excluding China, growth in developing East Asia is expected to decline from 6.2 percent in 2012 to 5.2 percent in 2013, before rebounding to 5.3 percent in 2014 and 5.7 percent in 2015.

- Although high by global standards, domestic demand is also slowing, as large stimulus programs introduced in the post-global financial crisis period are being phased out.

- Global growth momentum accelerated during the second and third quarters of 2013.

- The second quarter of 2013 marked the first time in 30 months that the economies of the Euro area, Japan, and the US all posted positive growth.

- Net export has hardly contributed to growth in recent years, but the most recent data suggest a recovery in trade is in the making and open economies such as those in East Asia stand to benefit.

- Capital flows to developing countries rose strongly in September, partially reversing a decline between June and August.

- Commodity prices have been softening over the last year, in particular prices of metals ore, palm oil, rubber and non-oil energy, which affect export performance countries in the region.

- Rice prices have fallen 13 percent since May and are now at their lowest level since September 2010. Together with a drop in maize prices, important for feedstock, this could reduce food price inflation in the region.

- Immediate risks include:

- the uncertainty surrounding the fiscal deadlock in the US

- the impact of the withdrawal of monetary stimulus from advanced economies

- an abrupt slowdown of investment in China.

- The Federal Reserve’s decision to delay tapering of quantitative easing stabilized markets for now, giving countries some reprieve and a second chance to take measures to lower risks from future volatility, including a reduction of reliance on short term and foreign exchange denominated debt and continued flexibility in the exchange rate.

- Tapering in the US could in part be offset by the planned monetary expansion in Japan. Japan’s Abenomics includes a doubling of the money supply by the end of 2014, which would translate into some $55 billion per month in asset purchases by the Bank of Japan—almost as large as the US’ $80 billion—and the regional impact could be considerable.

- In the long term, as higher global interest rates are likely to affect investment, accelerating growth and poverty reduction depends critically on structural reforms.

- China appears to be on the cusp of major reforms—including changes in the way they manage urbanization, the household registration system and financial sector. Such reforms would help China rebalancing of its economy, increase the efficiency of investment and maintain a relatively high growth rate.

- Countries need to improve their investment climate and invest more in infrastructure, while making public investment more efficient.

- They also need to address fiscal risks and create space to support long-term growth, with measures including reducing energy subsidies.