Key Achievements

- $1.4 billion committed across 11 Catastrophe Deferred Drawdown Option (Cat-DDO) Disaster Risk Management (DRM) projects in countries in Latin America and the Caribbean (LAC) (1)

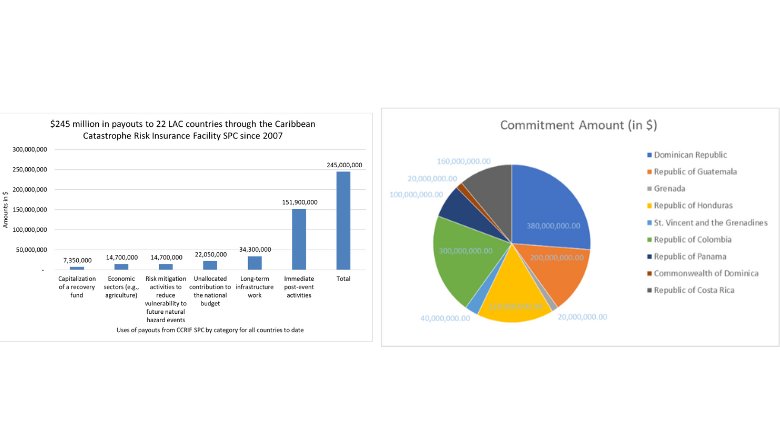

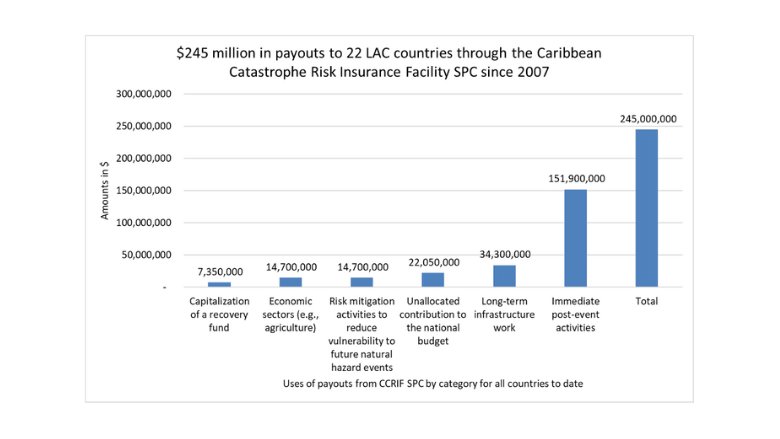

- $261 million in payouts to 16 out of 23 (70 percent) LAC countries through the Caribbean Catastrophe Risk Insurance Facility Segregated Portfolio Company (CCRIF SPC) since 2007, reaching 3.5 million beneficiaries. (2)

- $4.3 billion of extreme earthquake and hurricane risk in LAC countries transferred by the World Bank to reinsurance and capital markets since 2007 through insurance and catastrophe bond (cat bond) transactions. (3)

- Disaster Risk Financing strategies supported in 15 countries to strengthen fiscal resilience to disasters through improved access to and timeliness of post-disaster financing. (4)

Approach

A Cross-cutting Strategy for Disaster Risk Management

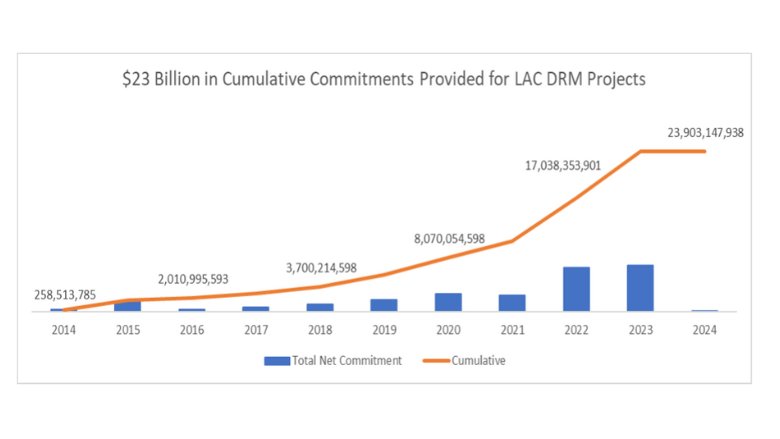

The World Bank supported 98 countries globally in the fiscal year 2022 (FY22) in prioritizing disaster risk reduction and delivered $31.7 billion in climate finance.7 Between FY218 and FY23, it committed $1.4 billion across 11 Cat-DDO DRM projects in 10 LAC countries.8 The Caribbean Catastrophe Risk Insurance Facility Segregated Portfolio Company (CCRIF SPC), established with co-financing from a World Bank-administered multi-donor trust fund (MDTF), provided sovereign insurance for earthquakes, tropical cyclones, and excess rainfall to Caribbean and Central American countries.9 Since 2007, 19 countries in the Caribbean and four in Central America have joined the CCRIF SPC, with 58 payouts to members totalling $261 million and benefiting over 3.5 million people.10 Since 2007 the World Bank has transferred $4.3 billion of extreme earthquake and hurricane risk in LAC countries to reinsurance and capital markets, with $1.3 billion of risk currently outstanding for Mexico ($485 million hurricane and earthquake cover from World Bank catastrophe bonds (cat bonds), Jamaica ($185 million hurricane cover from World Bank cat bond), and Chile ($630 million earthquake cover from dual World Bank cat bond and swap transaction). World Bank support for governments in LAC enhancing DRM has focused on five areas: risk identification; risk reduction; preparedness; financial protection; and resilient reconstruction.

Results

A Record of Building Resilience across the Region

The World Bank is expanding LAC countries’ access to the information they need to identify risks and make informed decisions to manage them. The Global Program for Resilient Housing (GPRH) is supporting the capital district of Bogotá, Colombia, to identify homes and neighborhoods that need to be improved in 12 priority areas of the city.11 Using artificial intelligence to analyze images collected through terrestrial and aerial mapping, the program aims to have families living in better, greener, safer homes before the next disaster strikes. “This technology will help the city plan and implement future housing and urban upgrading investments in the most vulnerable areas,” said Nadya Rangel, Secretary of Habitat for Bogota.12 At the national level, the government of Colombia is establishing a Land Information System to track implementation of DRM at all administrative strata.

In the area of risk reduction, the World Bank has worked with the government of Ecuador on a series of measures that included strengthening national DRM systems; constructing and rehabilitating critical public infrastructure; providing cash transfers in the wake of emergencies; and developing the country’s first Disaster Risk Financing Strategy. Between 2016 and 2018, the project helped protect more than 200,000 people and 173,500 hectares of crops by constructing six flood prevention and mitigation infrastructure works, dredging drainage channels and a riverbed, and constructing walls along three riverbanks. It also supported the modernization of 284 health facilities in several provinces to serve nearly a million residents affected by a 2016 earthquake and the El Niño phenomenon.13 More than $45 million in emergency cash transfers was provided to more than 380,000 vulnerable households during the initial COVID-19 lockdown; 88 percent of beneficiary households were female-headed. The project directly benefited 2.3 million people.14

An Inclusive Approach Enhances Disaster Preparedness in HondurasSince 2000, the government of Honduras, with World Bank technical and financial support, has implemented systematic reforms to strengthen DRM and climate change adaptation, focusing on poor and vulnerable populations. The Disaster Risk Management Project strengthened national, municipal, and community-level disaster risk preparedness; implemented a series of structural and nonstructural mitigation measures that built community resilience to hydrometeorological events; and supported the government’s capacity to respond promptly and effectively to emergencies. As of December 2022, the project, supported by the International Development Association (IDA), benefited 1.3 million people, 52 percent of whom were women.15 The project strengthened national-level DRM capacities with improvements in hazard knowledge and early warning systems though investments in the National Center for Atmosphere, Oceanography and Seismic Studies and in hazard monitoring stations that collect and transmit data on natural hazards. The project also helped improve municipal-level-preparedness, with 18 municipalities and 38 cities adopting DRM and emergency plans. The development of an Indigenous People’s Plan through consultation with Indigenous Peoples and the Afro-Honduran population provided the national DRM Agency with a better understanding of the needs and risks these communities face, while building local preparedness for the most vulnerable communities. Calixta Martinez is a project beneficiary and community leader in the department of Atlántida. “The project was very helpful,” she says. “We learned about disaster risk mitigation, and when Eta and Iota struck Honduras, there was no loss of lives in our community. Alerts were issued to the population in advance, due to the capacity building given to us by the project, and we alerted other neighboring communities on time.”16 |

As disasters in the Caribbean region intensify due to climate change, the World Bank is supporting financial protection and greater fiscal resilience for Caribbean economies. Instruments include innovative disaster risk financing mechanisms like risk insurance pools, cat bonds, and contingent credit lines. The CCRIF SPC, for example, is a parametric insurance facility that provides quick, short-term liquidity in the event of a disaster, and has made payouts totaling $261 million since its inception.17 A financial package of more than $100 million was provided to Dominica, in part through IDA’s crisis response window (CRW) after Hurricane Irma in 2017. Cat DDOs were approved in 2020 for Saint Vincent and the Grenadines and Grenada, and in 2022 for Dominica. Two days after the eruption of the La Soufrière volcano in Saint Vincent, $20 million was disbursed to support the response to the crisis, the first large financial assistance provided to the country following the eruption.18

The World Bank’s Capital at Risk Notes program19 provides World Bank clients with risk transfer solutions, through issuing cat bonds where client risk is transferred to capital markets investors, exposing the bonds’ principal to the underlying disaster risk. In Jamaica, in 2021, the government secured $185 million insurance cover for three hurricane seasons through an innovative cat bond issued by the World Bank and financed by donors through a World Bank operation. The government of Jamaica was the first government in the Caribbean region to independently sponsor a cat bond. The World Bank is exploring replicating this operation region-wide to add another layer of financial protection against disaster risks for Caribbean countries. In March 2023, the World Bank issued a joint cat bond and swap transaction that provides a total of $630 million of earthquake insurance cover to the government of Chile, consisting of $350 million of cat bonds and $280 million of catastrophe swaps.20 This transaction enabled Chile to access a larger amount of risk bearing capacity than either the insurance or cat bond market could offer on its own. These risk transfer transactions make funds readily available in the case of disaster, protecting government budgets, and reducing the potential need to mobilize debt in an event’s aftermath. Chile’s risk transfer transactions brought the total amount of disaster risk transactions intermediated by the World Bank to nearly $6 billion—highlighting the role of the institution in helping member countries access risk insurance through the insurance and capital markets.

A Historic Multi-Country Bond IssuanceIn 2018, the World Bank issued cat bonds that collectively provided $1.36 billion in earthquake insurance cover to Chile, Colombia, Mexico, and Peru—all members of the Pacific Alliance, a Latin American trade bloc.21 This was at the time the largest sovereign risk insurance transaction ever, and the first time Chile, Colombia, and Peru accessed capital markets to obtain insurance for disasters. In 2019, the government of Peru received a $60 million payout after a magnitude 8.0 earthquake. Mexico became the first country to sponsor cat bonds in 2006; the World Bank has supported Mexico’s disaster risk management and transfer activities ever since, partnering with the government on multiple separate cat bond transactions and a series of analytical and advisory activities to support broader DRM policy making, including most recently the review of the federal catastrophe insurance policy. Mexico renewed its earthquake and storm protection through four cat bonds issued by the World Bank in 2020 ($485 million) and has already requested World Bank support to renew that coverage, which is expected to expire in 2024.22 The support will be delivered as part of a comprehensive World Bank technical assistance to review and document Mexico’s national disaster risk financing strategy more broadly. The $630 million dual cat bond and swap transaction for Chile in March 2023 renews and expands the earthquake cover Chile put in place through this transaction. |

The World Bank supported Haiti’s resilient reconstruction efforts following a 2010 earthquake and Hurricane Matthew in 2016. The January 2010 earthquake was the worst humanitarian disaster in recorded history in LAC, with the loss of 220,000 lives and the displacement of another 1.5 million people. Damages, including to housing, agriculture, water and sanitation, education, transport, health, and energy, were valued at $7.8 billion.23 The project helped develop a roadmap for the legal basis of a national DRM system, which was adopted in 2020 and included the creation of the General Civil Protection Directorate (DGPC), strengthening the system’s structures at the central and territorial levels.24 Investments in resilient road networks benefited 150,000 people. The project built capacity in the Ministry of Public Works, Transport, and Communication (MTPTC), and new technologies supported access to improved risk information.