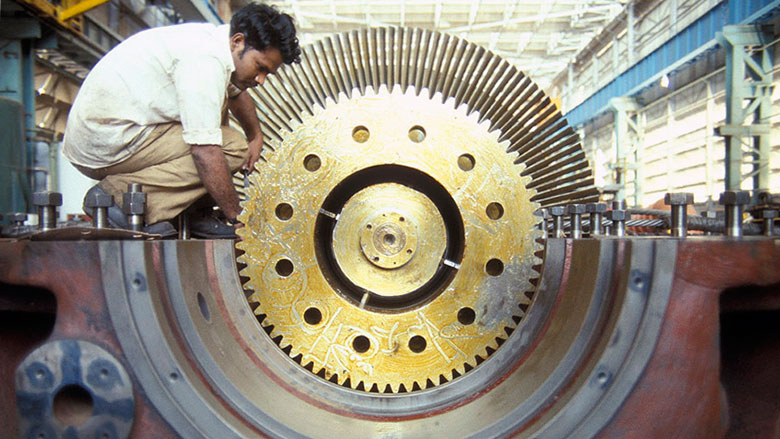

In India, Micro Small and Medium Enterprises (MSMEs) account for more than 80% of total industrial enterprises, employ an estimated 117 million people, and contribute more than 40% to manufacturing output and exports. Over 50% of MSMEs are rural enterprises widely distributed across low-income states, making them an important sector for promoting inclusive economic growth and poverty reduction.

With one million people entering the labor force every month in India, MSMEs have the potential to be an important source of wage employment and entrepreneurship. However, lack of adequate access to finance has remained the biggest challenge for these small enterprises to grow, compete, respond to shocks, and create jobs. The MSME census of 2006-07 found that about 87% of MSMEs in India did not have any access to finance and were self-financed.

A World Bank project is helping address the key constraints for small businesses in India. Approved in 2015, the $550 million project supports innovative financial products, frameworks and tools for MSME financing. It is the World Bank’s first loan to support start-up debt development and franchising finance to India.

Debt financing for early stage companies is virtually non-existent and MSMEs also lack mezzanine risk capital products. The lack of debt financing options for small entrepreneurs in India has meant that businesses grow slower and are less able to take advantage of economic opportunities.

Another example where traditional bank lending hasn’t catered well to small businesses is the lack of franchising financing frameworks. The MSME project in India aims to support the development of innovative financial products to franchisees as well.

The World Bank has been working with the Small Industries Development Bank of India (SIDBI, the apex development bank for MSMEs), providing a credit line of $500 million and supporting SIDBI’s efforts in direct and indirect financing, leveraging SIDBI’s role as a “market making” institution to boost private sector financing.

The credit line supports scaling up of lending to start-ups (including non-collateralized loans) and early stage enterprises that focus on innovation and/or technology. The credit line also supports the crowding in of the private sector toward this segment through on-lending. This area of lending is on the frontier of innovative financial development.

For this project, the FIRST Initiative and the SME Global Facility are providing technical assistance to help enhance institutional capacity, product innovation and development, reach out to stakeholders and disseminate innovation.

As of March 2017, the MSME project—one of the largest disbursing project in the India portfolio—has disbursed $265.38 million in facilitating financing to MSME.

This is an example of a World Bank Group innovation in MSME financing, exploring new product lines for borrowing country, leveraging and scaling up local innovations, and addressing the rapidly changing needs of a dynamic economy.