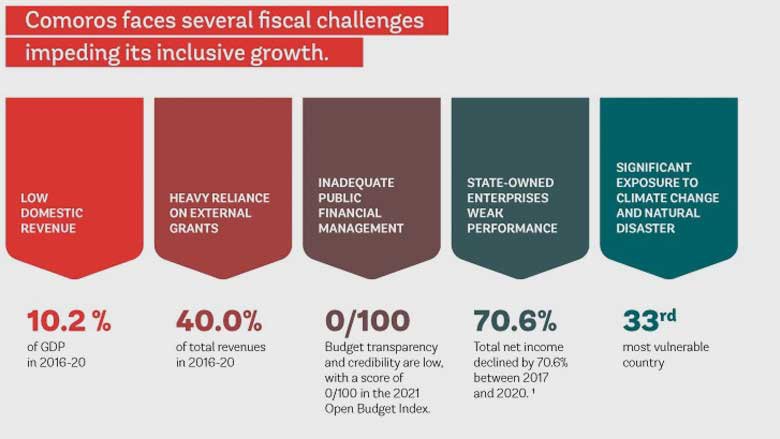

The Union of the Comoros faces modest economic expansion and fiscal issues which have had an impact on long-term growth. Economic activity is undiversified, characterized by a small, largely informal, private sector with limited value added. Labor force participation has been low, and the poor quality of education has persistently undermined the contribution of human capital to productivity growth. The low human capital mirrors the need for the fiscal policy to be more inclusive and efficient to boost growth.

The Comoros Public Expenditure Review (PER) analyzes core elements of the fiscal policy and its implementation, providing advice on ways to improve public expenditure efficiency and create fiscal space with the long term goal of supporting public service delivery, ensuring fiscal sustainability, and achieving inclusive growth.

The main recommendations for policies and reforms include:

Increase domestic resource mobilization

Comoros’ total government revenues have been below levels observed in peer countries. Comoros domestic revenues are heavily driven by indirect taxes which represent about 75% of tax revenues, but due to a weak tax administration and unassessed tax exemptions, several tax instruments are not sufficiently effective. This situation is reducing the government’s capacity to provide public services that would help unleash Comoros’ growth potential and address lingering development challenges. Strengthening the tax administrations and reducing tax exemptions could help to boost revenues.

Key policy options include (i) a reform of the tax administration to exclusively focus on tax matters and improving identification of taxpayers; (ii) the reduction and improved monitoring of tax exemptions; and (iii) an automated exchange of information on taxpayers between the administration and key stakeholders involved in the taxation cycle.

Increase public investment expenditure efficiency through better planning

Fueled by external fundings, public investment increased from an average of 25.7% of total public expenditures in 2010–12 to an average of 36.8% in 2013–21. However, public investments were less efficient in Comoros than in peer countries. Public investment management in Comoros faces challenges and there is a need to improve the planning functions, ensure that investment is allocated to the right sectors, enhance monitoring mechanisms, and enforce the public procurement law to deliver productive and durable assets.

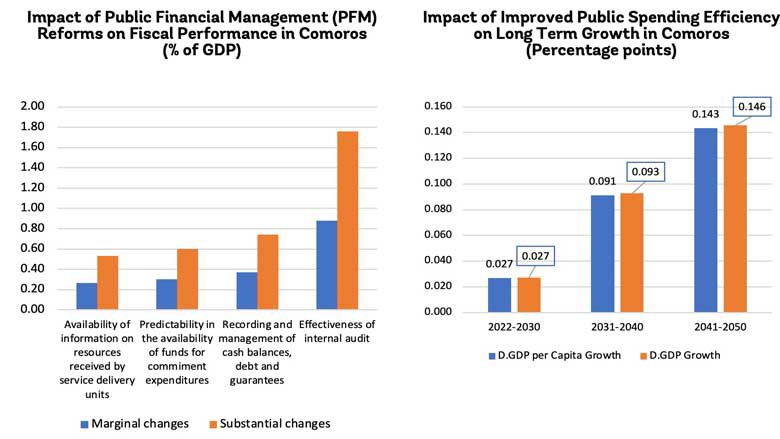

Strengthen the public financial management system by increasing transparency, and enhancing internal and external control on budget execution

The country’s public financial management system is inadequate to effectively implement government policies, and the overall system has not been improved since 2016. Challenges face the country’s public financial management system at different stages of the budget cycle.

Policy options that could help address this include enhancing fiscal transparency, improving public expenditure efficiency, and creating an internal audit function within the ministry of finance.

Improve public health expenditures efficiency through better planning, and enhanced procurement

A special focus of the PER identifies key issues that need to be given immediate attention to improve the health of the population. First, households still pay for the lion’s share of health expenditures through high out-of-pocket payments and inadequate public financial management in the health sector has resulted in very low budget execution and a lack of transparency in spending, including for the recently launched health insurance program. Despite recent reforms, the pharmaceutical program is underfunded and combined with weak procurement has contributed to high stockout rates for essential medicines, service disruption, and high prices for patients. The size of the health workforce has increased, but only half of health staff are on the government payroll, and more than half of them do not show up for work. The government is focused on reconstructing the El Maarouf National Hospital but this would result in a substantial increase in health expenditures.

Some recommended policy options to help this situation include finalizing the construction of El Maarouf Hospital within the health system context, establishing ways of using government health expenditures efficiently and investing in pharmaceutical procurement to improve health service delivery and population health, and transforming health workforce management and education.

Reduce fiscal risks from SOEs

State-owned enterprises (SOEs) make up an important part of the Comorian economy and the government budget (43% of the national budget), but they are mostly low-performing and lacking in oversight which creates significant fiscal risks. Updating the legal framework and enhancing monitoring could help lessen the risk and help build strength in this portion of the economy.

Enhance disaster risk management

The Union of the Comoros is exposed to a wide range of climate and natural disasters, but disaster risk management is not explicitly documented in the national budget. In 2016-20, an average of $2.0 million was allocated to expenditures related to disaster risk management each year although budget execution has been volatile and difficult to monitor due to data availability. This represents 2.6% of the national budget.

Better risk and vulnerability assessments, along with explicitly documenting risk reduction investments in the national budget could boost the country’s ability to prepare for such risks. Strengthening the National Disaster Risk Reduction Fund and collaboration between key sectoral ministries involved in disaster risk management would also enhance the country’s ability to survive when these crises occur.