When Tropical Storm Urduja brought one meter of rain to the Philippines in just three days in December 2017, it caused significant damage to the electricity generation facilities of the country, reducing capacity by 50 percent at the power plant owned by Energy Development Corporation (EDC) Philippines. EDC Philippines realized that existing infrastructure was not resilient enough to evolving climate-related disasters, including record typhoon wind speeds and increasing amounts of rainfall.

To boost community resilience, EDC Philippines provided trainings on disaster response for schools, residents and local government officials in host communities, along with establishing an innovative network of first responders in project sites across the country. EDC Philippines also built its own resilience by embedding climate risk into decision-making and investing in critical points of infrastructure, with the support of a peso-denominated green bond issued by the IFC.

The case of EDC Philippines is but one critical example of private sector investment in building climate resilience, as documented in the new World Bank Group report: Enabling Private Investment in Climate Adaptation & Resilience: Current Status, Barriers to Investment and Blueprint for Action.

The report brings together IFC and World Bank teams to focus on how to boost adaptation finance from the private sector. It documents the main barriers that have stymied private investment in adaptation and lays out a systematic approach to address these barriers and close the adaptation finance gap.

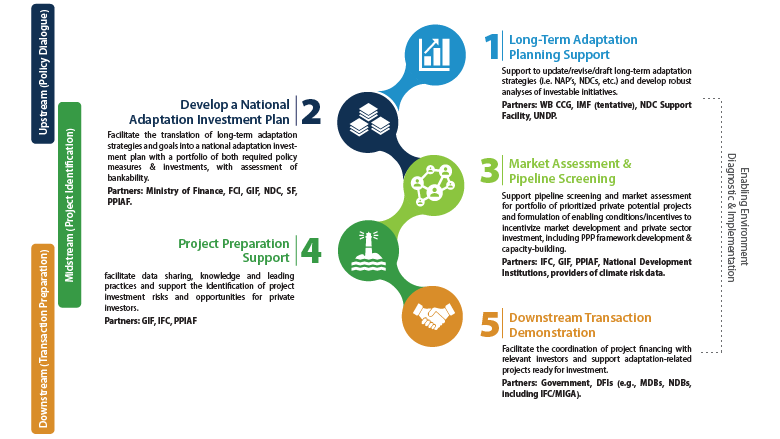

The report proposes a blueprint for action to develop, finance, and implement priority adaptation and resilience investments— one driven by countries’ goals and national investment plans— that can help accelerate and scale up investment to address the needs of the world’s most climate-vulnerable communities and economies. The public sector plays a critical role in mobilizing private investment. Multilateral development banks, and the World Bank Group in particular, have an important role to play as conveners and facilitators for this approach to take root.

“Our new WBG report finds that by best existing estimates, of the total $30 billion spent on adaptation in 2017-18, only roughly $500 million--a mere 1.6%--came from private adaptation spending. Private sector investment in adaptation has remained conspicuously minimal,” said Dr. Arame Tall, lead author of the report. “Our report finds it is mission possible to mobilize private sector investment in adaptation and resilience, provided the right set of incentives, metrics, conducive policies and enabling environment, as well as a clearly articulated climate adaptation investment portfolio, are in place to attract private investors.”