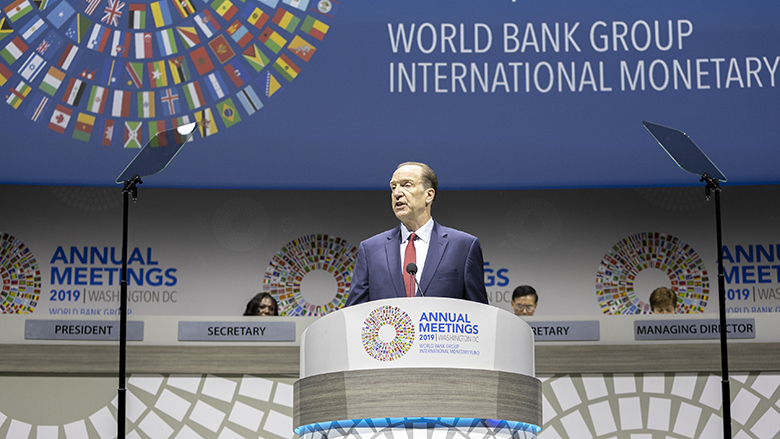

Chairman Sayed-Khaiyum, IMF Managing Director Georgieva, Governors and distinguished guests, thank you for joining us at the Annual Meetings. I’d like to welcome former World Bank Group President James Wolfensohn, who is with us here today. Thank you, Jim--and thank you to the many other leaders in the audience--for your hard work, leadership and service.

Thank you, Chairman, for your remarks. The delegates who gathered at the Bretton Woods conference 75 years ago faced great uncertainty. War was raging in Europe and the Pacific. The world economy had been hammered for over a decade by high tariff barriers, depression and war.

As the conference opened, U.S. Treasury Secretary Morgenthau said the new global system should be based on two ideas. First, there’s no limit to prosperity. Second, broadly shared prosperity benefits everyone. He expressed hope for a “dynamic world economy” where people of every nation have an opportunity “to raise their own standards of living and enjoy, increasingly, the fruits of material progress.”

At the World Bank Group, we’re determined to help countries make that hope a reality. Even while the global economy is facing a weak patch, we believe living standards can rise in many countries. We’re committed to our goals of reducing extreme poverty and boosting shared prosperity--goals at the core of the Bretton Woods purpose and at the core of our annual meetings.

My time as president has reinforced my conviction about the urgency of our mission and the challenges we face. Some countries have made great strides in helping the poor, yet one in 12 people on the planet still live in extreme poverty, many of them in fragile and conflict-torn places. Existing institutions often aren’t able to deliver benefits to those in need, and projections for several countries show that poverty is likely to increase, not decrease.

I’ve benefited from productive trips to developing countries: Egypt, Ethiopia, Madagascar and Mozambique. I expect to visit India, Pakistan, Mexico and China in coming weeks to encourage fast progress toward better policies, broad-based growth and higher living standards for all. One of the most valuable activities has been my time spent in individual meetings with world leaders--nearly a hundred heads of state since my nomination. I hear their perspectives, learn their challenges, and am encouraged by their openness to reforms that can boost growth, jobs and incomes.

I would like to present a broad update on the World Bank Group. This builds on two of my recent speeches. At the Peterson Institute, I described the weak global economic outlook, which is especially apparent in Europe, as well as trade and geopolitical uncertainty, sluggish investment rates and frozen capital in low-yielding bonds. This combination of factors presents grave challenges for development. At McGill University last week, I described some of our development tools that give us cause for optimism. We seek material impact in terms of broad-based growth, transparency, the rule of law, and private sector expansion--working in an effective way through a range of products including loans, credits, guarantees, grants, equity investments, insurance, and advisory and risk-management services. I invite the input of the Governors on these topics and welcome the accumulated wisdom of those here today and others in the development community.

Implementing the Capital Increase

One of our major undertakings is implementing the capital increase package endorsed by our shareholders in 2018. I want to take this opportunity to thank shareholders for their support, which is enabling implementation of key reforms. Many members have submitted their IBRD subscription documents, with a few members already completing their subscription payment process. I encourage other members to do so as well.

I’m pleased to report that, since the IBRD capital increase reached the 75% hurdle for shareholder approval a year ago, IBRD’s subscribed capital has increased by $8.7 billion, nearly 15% of the agreed increase.

The IFC capital package is close to the required shareholder approval hurdles. We’ve extended the voting period to March 18, 2020. IFC is moving to execute the capital-increase plan, shifting its focus to working “upstream” to open markets and create projects that will increase private investment in all countries, especially the poorest ones.

The Multilateral Investment Guarantee Agency grew significantly under its FY18-20 strategy. Growth was driven by a deepening partnership with the Bank and IFC, an increasing focus on business development and product innovation. MIGA has expanded its reinsurance to seventy percent of gross exposure. This will allow MIGA to sustain its growth in the medium term as global macro and business conditions evolve.

We’re working to increase the share of loans to those IBRD borrowers who are below the graduation threshold. As part of our country partnership frameworks for higher-income IBRD borrowers, we are systematically analyzing and assessing key elements of the IBRD graduation policy. This will shift the Bank’s lending profile substantially, helping countries that need it the most but also weighing on net income. We’ve adjusted our loan pricing, and other financial measures are under way to improve IBRD’s financial sustainability. In June, the Board approved a crisis buffer amount, as well as an annual limit on our lending to make sure that IBRD stays financially sustainable without additional capital increases.

Management is committed to cost discipline throughout the year. The Expenditure Review achieved $4.8 billion in expected savings over Fiscal 2019 to Fiscal 2030, and progress is being made toward achieving the additional cumulative efficiency gains of $1.8 billion from the capital package. For IBRD, cost discipline will be complemented by tighter target zones for the “budget anchor,” the ratio of administrative expenses to business revenues. Fiscal 2019 was the first year in many decades when the administrative expenses of IBRD and IDA were less than their business revenues. As part of the World Bank Group capital increase, we are committed to an ambitious new target to bring the ratio of IBRD administrative budget to loan spread income down in steps, achieving a target range of 50-60 percent by FY30. The anchor goals are demanding, but the Bank is committed to them.

Replenishing IDA

Ensuring the International Development Association is properly financed is a vital step in supporting the Horn of Africa, the Sahel, and our development goals around the world. IDA is the world’s largest and most effective platform for fighting extreme poverty. The current IDA 19 replenishment cycle, the nineteenth three-year cycle, is making good progress, and I’m encouraged by the engagement with donor countries. Consultations with IDA partners will continue in the coming months to finalize the policy package and financing framework for the IDA19 cycle.

At the same time, IDA is continuing to work toward good development outcomes with existing funds. We’ve been scaling up our commitments to countries affected by fragility, conflict and violence, as well as bolstering the ability of borrower countries to respond to crises, including through the Crisis Response Window. Since 2010, IDA funding has helped 769 million people receive essential health, nutrition, and population services, including immunizations for over 300 million children. It has improved access to water services for nearly 100 million people. It has helped to recruit or train 13 million teachers. And it has helped to build or improve more than 146,000 kilometers of roads.

There’s an urgent need for IDA funding, and we’re counting on the continued strong support of our shareholders and donor countries in funding IDA as we address these challenges. The IDA19 replenishment is based on five special themes: jobs and economic transformation; fragility, conflict and violence; climate change; gender and development; and governance and institutions. It will also incorporate four cross-cutting issues: addressing debt vulnerabilities, exploiting opportunities from digital technology, investing in people to build human capital, and promoting inclusion of people with disabilities. The package includes a significant scale up of the regional program, as well as a further increase in FCV resources. The Private Sector Window, introduced in IDA18 together with IFC and MIGA, will continue to help mobilize private capital and scale up private sector development, particularly in fragile situations.

IDA19 will expand IDA’s regional program, as well as increase resources for fragile situations. We expect to see poverty become more concentrated in fragile and conflict-affected states, with many refugees fleeing to countries that already struggle to deliver basic services, security and peace to their citizens. Notably, IDA commitments to countries affected by fragility, conflict and violence reached $8 billion in Fiscal 2019.

Regarding peace and security, let me highlight just one out of dozens of memorable meetings. At the end of April, I met with Ethiopian Prime Minister Abiy Ahmed. He described with passion his work toward peace in the region, his peace-making trips to neighbors, and his dramatic economic program, which we are supporting with one of our biggest programs in the world. I phoned Prime Minister Abiy on Friday after he was named the winner of the Nobel Peace Prize. With senior colleagues in my office from around the World Bank Group, women and men who have worked so hard on Ethiopia and the region, we congratulated him on receiving one of the world’s most prestigious honors. Thanks in part to his efforts and others in the region, the Horn of Africa has the chance to break out of its long period of violence.

In recent weeks, I’ve had the chance to meet with and encourage the nearby heads of state of Sudan, Somalia, Kenya, Rwanda, and Egypt, and others at the World Bank are also meeting with South Sudan, Eritrea and Djibouti. We can all take a moment today to look for ways to help this important region move dramatically forward.

Personnel Is Key

This brings me to the importance of World Bank Group personnel, who bring their dedication, skills and experience to the job every day. I’ve welcomed spending highly valuable time with hundreds of our development professionals. One of the most dynamic is Kristalina Georgieva. I’d like to take the opportunity now to recognize Kristalina’s accomplishments and congratulate her on her appointment as Managing Director of the IMF.

Congratulations, Kristalina. We will miss you across the World Bank Group--it’s a loss for me and all of us--but we look forward to your strong leadership at the IMF and to working with you toward growth programs in developing countries.

I’d like to report on the transition in leadership. It’s been fast moving, and is going smoothly. Congratulations to our new Managing Director, Axel van Trotsenburg. Many of you here know the depth of his experience and expertise--including regional operations, IDA replenishments, relationships with stakeholders, and leadership skills, to name a few. I work closely with Axel, and we’re looking forward to innovation, continuity of purpose, and strength of implementation.

Congratulations also to Managing Director Anshula Kant, who started October 7 as Chief Financial Officer. Anshula brings more than 35 years of expertise in banking, finance, technology and management, most recently as managing director of the State Bank of India.

Thank you to IFC’s CEO, Philippe le Houérou, for adding to his current tasks the role of co-chair of the IDA-19 replenishment, along with Antoinette Sayeh.

I’d like to thank Keiko Honda for her six years of work at the Multilateral Investment Guarantee Agency. We’re reaching the conclusion of a broad search for her replacement, and I hope to have an update in the coming weeks.

Looking throughout the World Bank Group, we recognize the challenges of leadership transitions but also the opportunities to focus on the mission, work hard and benefit from change. I look for input from employees and other stakeholders. While differences of view are common--and necessary for good decision-making--I’m pleased with how people are working together, and I’m confident we’re well positioned to provide solid progress on behalf of our stakeholders.

IBRD, IDA, IFC and MIGA are working together to make us more effective, efficient and accountable. Steps include coordinating our country programs, co-locating offices, aligning staffing to meet the needs of country programs, adjusting the global footprint of the WBG to increase our presence in lower income countries, providing employee benefits that are attractive for the task and fair to stakeholders, and developing country platforms that will help governments work more effectively with the entire investor community. We’re encouraging more staff exchanges between the WBG entities and more joint teams working together on a problem to create better solutions for clients. Successful implementation of these processes is critical to our mission.

Financial Results

Over the last few months, we’ve reported on our financial results in several ways. For our fiscal year ended June 30, 2019, we published commitments, financial statements, a detailed “management discussion and analysis,” and the recently released annual reports. We believe in transparency for our borrowers and want to practice it ourselves. The financial results from the fiscal year highlighted the strength of the financial positions of the World Bank Group entities, steady demand for financing, and continued support from shareholders.

We are working to increase our commitments to lower-income countries as they improve their development outlook and to shift resources toward countries suffering from fragility, conflict, and violence. We’ve doubled core allocations for FCV-affected countries to more than $14 billion under IDA18. The Global Concessional Financing Facility (GCFF) has provided around $500 million in grants to unlock more than $2.5 billion in concessional financing for Jordan and Lebanon to help address the influx of Syrian refugees, as well as for Colombia to help address the needs of more than 1.4 million displaced Venezuelans and their host communities.

For Fiscal 2019, World Bank Group commitments reached nearly $60 billion.

IBRD’s commitments were on par with the prior year at $23 billion, while disbursements increased by 16% to $20 billion in Fiscal 2019. Commitments to countries below the graduation discussion income threshold were over 70% last year. To strengthen financial management, IBRD introduced a financial sustainability framework and lending limit.

Considering loan repayments received, net disbursements were $10 billion in Fiscal 2019. This increased IBRD’s loan portfolio to $193 billion, 5% above a year ago. With the Fiscal 2019 balance sheet, IBRD netted its derivative asset and liability positions in alignment with the preferred accounting treatment and prevailing market practice. IBRD raised medium- and long-term debt of $54 billion during Fiscal 2019. Allocable income, the internal measure that IBRD uses to make net income allocation decisions, was $1.19 billion, which reflects the gradual impact of new pricing measures and will be used to increase reserves and support IDA.

Turning to IDA, its commitments were $22 billion in Fiscal 19. Net disbursements increased by almost a third, increasing the outstanding loan balance to $152 billion. IDA introduced its short-term debt instruments in the capital markets, with an outstanding balance of $1.9 billion as of June 30, 2019. Last week, it issued a 1.25-billion euro seven-year bond.

IFC concluded Fiscal 2019 with $8.9 billion in long-term financing from its own account and mobilized an additional $10.2 billion from other investors, for a total program delivery of over $19 billion. Income from the loan and debt securities portfolio, net of allocated funding costs, was $872 million. Income available for designations—the key internal measure—was $909 million in FY19. IFC raised medium- and long-term debt of $11 billion during Fiscal 2019. In Fiscal 2019, IFC adopted a new accounting standard that resulted in IFC reporting all gains and losses on investments in equity securities in net income.

MIGA provides political risk insurance and credit enhancement. It issued $5.5 billion in guarantees in Fiscal 2019, double the amount from six years ago, and mobilized $9.3 billion in development financing. Gross guarantee exposure was a record $23.3 billion, also more than double that from six years ago. MIGA reported a net income of $82.4 million in Fiscal 2019. Despite the portfolio growth, the capital utilization ratio (MIGA’s capital adequacy measure) remained stable at 47 percent. This reflects MIGA’s continued deployment of private sector reinsurance capacity to manage its capital, with 64 percent of the gross exposure ceded to reinsurance as of the end of FY19.

With one of the world’s biggest LIBOR-linked long-maturity balance sheets, we look forward to working on a proactive and orderly LIBOR transition, preserving the integrity of the financial model of the Bank while applying principles of fairness and transparency.

Work Program

Looking forward, we face a number of development challenges. I’d like to briefly identify those and explain some of our approaches. Global growth has slowed; investment rates in developing countries aren’t sufficient to meet development needs; health systems, learning outcomes and technology are falling further behind needs; climate changes and extreme weather are taking a heavy toll; for some countries populations are expanding much faster than resources and capacity; and many countries are facing fragility, conflict and violence, making development even more urgent and difficult. The result is that several countries are facing rising poverty rates and falling median incomes, the opposite of our mission.

We’re sharpening our focus on creating strong country programs to boost growth and improve development outcomes. To oversimplify, we –meaning the World Bank, IFC and MIGA--work through country offices and country directors, with the support of technical and program experts, to help governments create improvements. They can be tailored to a country’s and region’s unique circumstances.

Coordination with other MDBs is a key part of our development work. We’re encouraging better implementation of graduation and price differentiation to avoid undercutting each other’s work, covenants and standards. We’re working cooperatively with countries and the development community to launch country platforms. They can help countries prioritize their key development issues and encourage donors, including non-traditional donors, to engage in the most constructive way. There continue to be many international groups setting up yet more discussion groups on how to define, standardize, centralize and guide country platforms. The strong view of the World Bank Group is that there’s been ample discussion and final reports. The next steps are practical--for example, helping countries organize in-country meetings this month to prioritize their activities with major donors. We’re working on platforms with 11 countries so far. The outcomes will be tailored to the countries and their needs, and will increase the focus on private sector involvement and engagement. The goal is for the World Bank Group and the broader development community to be as effective as possible in helping countries achieve good development outcomes.

In this process, countries need to provide strong leadership to choose a path that works economically, socially and politically. It’s clear that the quality of policies and institutions plays a key role in explaining why some developing countries have been able to make the leap out of poverty, while others have been unable to advance. It’s also clear that development cannot be imposed from outside--country leadership and ownership matter.

Jobs and economic transformation are a key topic in the Development Committee discussions this week. Key building blocks include clean water and dependable access to electricity, markets and market pricing, especially for agriculture inputs and outputs. Key development steps are the establishment of a dependable rule of law that encourages transparency in government contracts and pensions, fights corruption, builds strong and accountable institutions and creates a level playing field so that the private sector is allowed to compete fairly with state-owned enterprises, the military and the government itself. For many countries, this means opening up their closed and protected markets, allowing prices to be determined by market forces, and liberalizing capital flows. The payoff is that countries that make this step attract more investment, both foreign and domestic, and can generate growth that benefits a broader part of the population.

The private sector must play a pivotal role in development. With official development assistance stagnant and public-sector debt growing in many countries, it’s critical that we pursue private-sector solutions and establish an environment that attracts private investors. The IFC and World Bank developed what we call the “Cascade” approach, which looks for private-sector solutions to development challenges and directs World Bank programs to overcome obstacles in the private sector framework. This approach is key to attracting new investment and boosting the impact of every development dollar.

The World Bank’s Systematic Country Diagnostic, and the IFC’s Country Private Sector Diagnostic, assess barriers to private-sector investment and recommends ways to address them. We’re working to deepen capital markets, which is key to long-term development. Through the Joint Capital Markets Program, or J-Cap, the IFC and World Bank are helping countries build local capital markets through reforms and investments from Bangladesh to Morocco.

A big obstacle to investment is the amount of a country’s sovereign and SOE debt and the lack of transparency surrounding the debt. Public debt in emerging markets and low-income countries has risen to levels not seen since the 1980s, and too much of that debt isn’t transparent. Some lenders, including Non-Paris Club lenders and private creditors, have imposed strict non-disclosure clauses on government borrowers; required liens and collateralization that violate the negative pledge clauses in our loan contracts; employed weaker procurement, environmental and social standards; placed guaranteed debt in state-owned enterprises and special purpose vehicles that undermine debt sustainability, and paid insufficient attention to non-concessional borrowing policies that are key to emerging from poverty.

When countries are transparent, they typically enjoy higher credit ratings, lower borrowing costs and better ability to attract foreign direct investment. But we’ve found that fewer than half of the countries we’ve reviewed meet minimum requirements for debt recording, monitoring and reporting. Lenders need to be more transparent, eliminating confidentiality clauses in their lending to sovereign borrowers.

It is also critical to have transparency in public spending and public pensions. We support public expenditure reviews to understand gaps in service delivery relating to resource allocation decisions and process-related bottlenecks. These diagnostics help countries develop more effective and transparent budget allocations, including in specific sectors such as health care, education or infrastructure.

Our development policy financing, which disburses against impactful prior policy reforms, will increasingly play a role in encouraging more transparent and sustainable borrowing practices as well as more effective and efficient public spending and policy reforms, so that citizens can see and evaluate their government’s obligations and the use of proceeds.

Transparency will help attract finance, innovation and expertise so countries can build the infrastructure they need. They face severe deficits in clean water, electricity, roads, and telecommunications that reduce connectivity and undercut job creation and access to markets. Trade facilitation is a critical part of many of our country programs because the economic benefits from commerce and trade are immense, and constructive policies--such as customs processing, tariff harmonization and standardized bills of lading--are achievable.

We’re putting substantial resources into closing the gender gap. In fiscal 2019, over 60 percent of combined IBRD and IDA operations helped address gender gaps and encouraged full incorporation of women in economies. Globally, countries are losing $160 trillion in wealth due to differences in lifetime earnings between men and women. Later today I’ll join a panel to talk about unleashing the potential of women entrepreneurs.

We’re investing in human capital. More than half of all 10-year-olds in low- and middle-income countries can’t read, which is unacceptable. In this week’s education and learning announcements, we set a target of at least cutting learning poverty in half. We’re also making important investments in health. Some of the goals: preventable maternal and child mortality, ensuring that women and children can access comprehensive health services, and reducing childhood stunting.

Massive growth of cities is an inevitable part of the outlook. It presents critical challenges--and opportunities--for development. One key example is the design and enforcement of street grids as cities grow. The World Bank Group is helping to build sustainable cities by investing directly in urban infrastructure and helping national and municipal governments develop fiscal and financial systems to expand revenues and provide access to private capital.

Climate and environment investments are a key part of the World Bank Group’s work, and in Fiscal 2019, we committed $17.8 billion to climate-related investments. Among multilateral development banks and other international organizations, we are the single largest funder of climate action, providing almost half of total climate-related finance. Over 30 percent of IBRD/IDA and IFC commitments included climate co-benefits in fiscal 2019, surpassing our target. We’ve doubled our climate commitment targets for fiscal years 2021-2025 to $200 billion.

We recently launched PROGREEN, an umbrella trust fund to boost efforts to stop deforestation, restore degraded lands, and improve livelihoods in poor, rural communities. We’re working through PROBLUE – a new, umbrella multi-donor trust fund – to help countries sustainably develop their blue economies. We’re aggressively expanding our work on marine plastics and the prevention of marine pollution. Our support helps countries provide clean air and water, healthy oceans, resilient cities, and sustainable food and agriculture systems. To scale up climate-related investments, we’ve launched initiatives such as Scaling Solar, which is helping countries accelerate development of utility-scale solar-energy plants. We’re one of the biggest financers of renewable energy and energy-efficiency projects in developing countries. During IDA’s current three-year funding cycle, we’ll contribute more than $1 billion annually to grid and off-grid solutions for electricity access in countries with the high electricity deficits.

Advances in digital technologies are another critical development path. A decline in transaction costs is particularly beneficial for new entrants to markets, women, small businesses and the poor. We’re almost at the point of having systems that would allow the poor to electronically receive remittances, foreign aid, and social safety net payments as well as their earnings, and then be allowed to save and transact freely. Once more countries enable these technologies, the innovation may turn out to be as big an advance in development policy as the ones that allowed people to move from a barter economy to a market economy. A key challenge is to make new systems compatible with the world’s interest in anti-money laundering and counter terrorism efforts. We’re helping client countries preserve correspondent banks and interact with FATF, the financial action task force, and helping FATF-style regional bodies interact with developing countries.

Financial inclusion and liberalization are core steps in development. We’re using Program-for-Results financing in a host of countries to encourage concrete outcomes and ensure accountability. We’re expanding our work to support correspondent banking relationships for developing countries, a key task in building stronger financial systems as well as helping to leverage technology-based solutions to improve financial inclusion.

As we work with countries, we want to listen to clear new thinking and the best available evidence. In that vein, we aim to produce research that cements the Bank’s reputation as a development innovator and thought leader. I was pleased to see that the just-announced Nobel Prize in economics highlighted development and the importance of data and careful evaluation of results.

Our recent World Development Report explained how the expansion of global supply chains has helped countries reduce poverty and boost shared prosperity. The Doing Business report, which we’ll release later this month, highlights progress on business formation rules. The Women, Business and the Law report helps identify barriers to the full inclusion of women in societies and economies. IFC’s Creating Impact report surveyed the market for impact investing and examined the conditions that would allow the market to realize its vast potential. The semi-annual GEP report on Global Economic Prospects, tracks economic trends. The June release downgraded our global growth outlook, and I expect a further downgrade in the next release.

Tackling the Challenge

I know I’ve left out many parts of our work program, but I wanted to mention some key parts. Global development is a complex challenge, but if we stay focused and keep our mission in mind, I’m confident we can help improve outcomes. At the World Bank Group, we have a strong culture, grounded in our founding principles and embodied by our hard-working staff. It’s important that we are open and transparent about how we do our work, and the results we achieve. I want staff and stakeholders to feel they have the freedom to raise issues in a culture of open, candid communication.

Our mission is urgent. Our shareholders have given us clear guidance through the capital increase package and have set high development ambition for IDA19. The IDA19 proposals cannot be achieved without the strong support of all development partners. I thank our IDA partners for their commitment and generosity. I’m confident that, working together, we can create better conditions, with stronger policy frameworks and more robust institutions aimed at broad-based growth that reduces poverty and boosts shared prosperity.

Thank you.