Download the Report | Download the Data | Download the Little Data Book | Executive Summary Visualization

Download the Report | Download the Data | Download the Little Data Book | Executive Summary Visualization

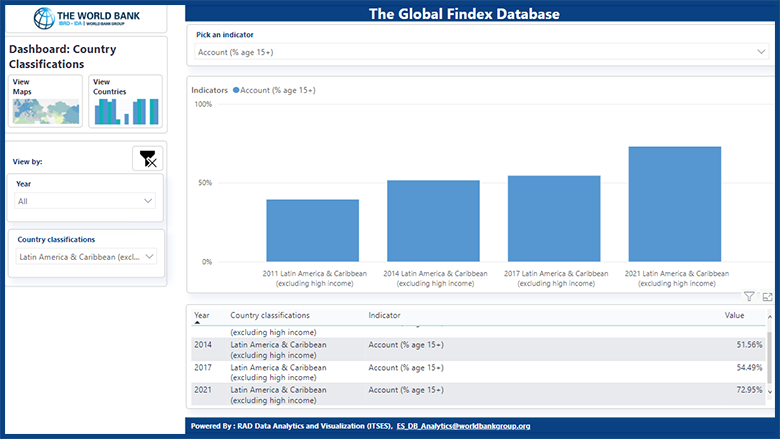

Download the Report | Download the Data | Executive Summary Visualization

The interactive data dashboard allows Global Findex data to be visualized, compared across countries, and downloaded.