Ladies and gentlemen[1],

Thank you very much to for the invitation to be here today to talk about the important issue of closing the protection gap in emerging markets and developing economies.

1. We are living in difficult times. The economic recovery is still sluggish, and global growth remains feeble. Policy uncertainty remains high against the background of rising geopolitical risks and pressing challenges arising from the gradual impact of climate change.

2. The near-term risks are within the traditional planning horizon of many economic and political actors, but the catastrophic impact of climate change is much less perceived as a clear and imminent threat. And we know that it will take a toll on future generations- but, sadly, our generation has few incentives to fix it, and most remain captive to blissful ignorance [see Exhibit 1]. But as Munich’s favorite son, actor, writer and comedian Karl Valentin cautioned almost a century ago- “Today is the good old times of tomorrow”- and, to be sure, he wasn’t even aware of climate change.

Exhibit 1

3. Being here in this wonderful city makes us forget all too easily that in other parts of the world, climate change is already a key source of economic vulnerability. In my native Brazil, the three most populous states had to deal with their worst drought in 80 years in early 2015. The lack of rainfall not only affected industry and agriculture, but the water supplies of hundreds of thousands of people, including in Sao Paolo and Rio de Janeiro. Such climactic shocks regularly hit countries in Sub-Saharan Africa, Southeast Asia, and the Caribbean as well.

4. This is why insurance and protection against natural disasters and climate risk is a priority for the World Bank Group- and the way we work with governments in becoming more resilient to adverse shocks affecting sustainable growth. Natural disasters and climate risk significantly slow economic progress and impose large costs on societies, especially on the poor and most vulnerable, and, thus further fuel inequality.

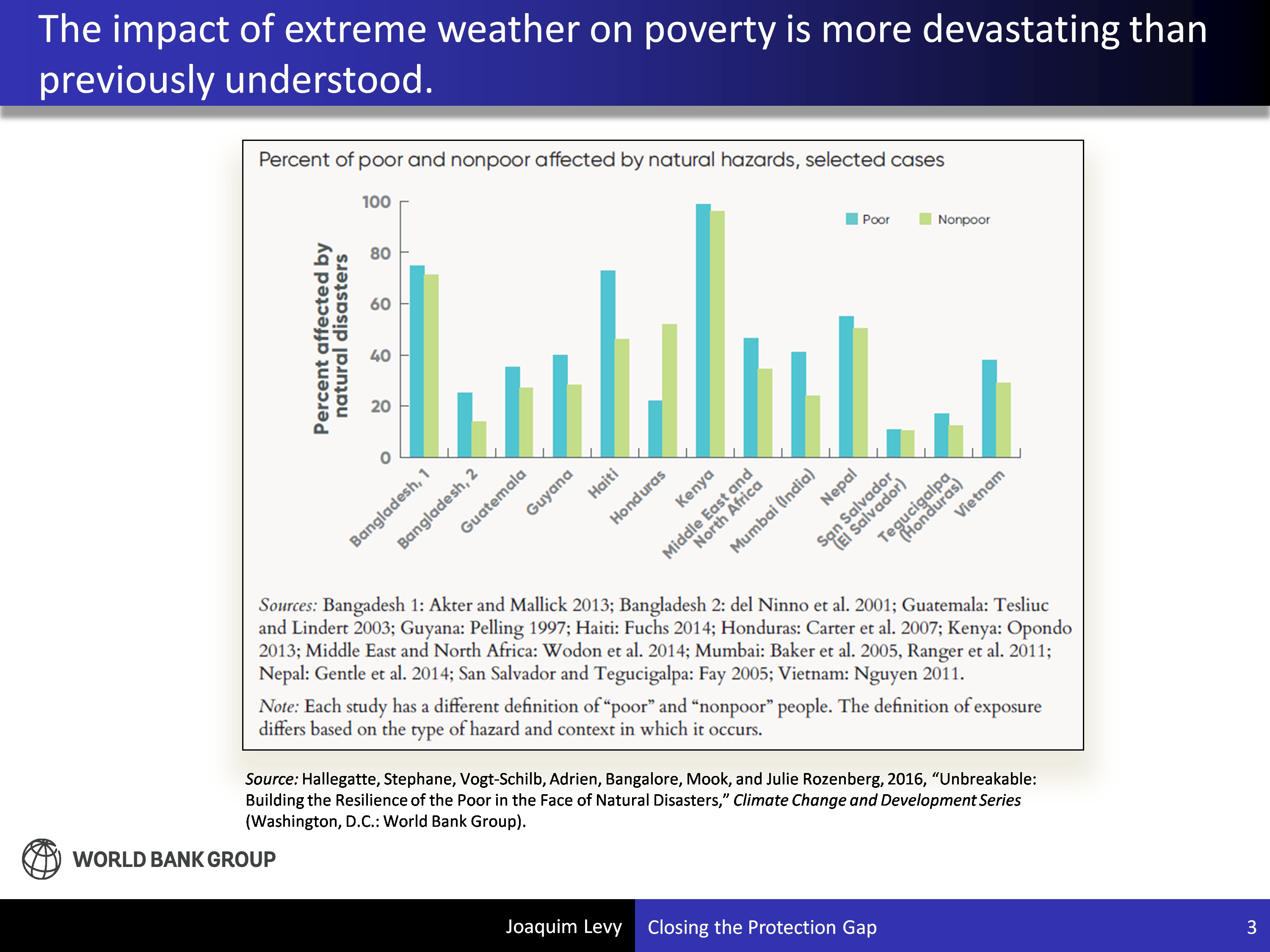

5. Because natural disasters tighten poverty’s grip on communities worldwide, disaster risk reduction goes hand in hand with poverty reduction [see Exhibit 2]. A new World Bank report entitled “Unbreakable”[2] finds the impact of extreme weather on poverty is more devastating than previously understood, responsible for annual consumption losses of $520 billion and pushing 26 million people into poverty every year. This makes our job of ending extreme poverty by 2030 even more challenging.

Exhibit 2

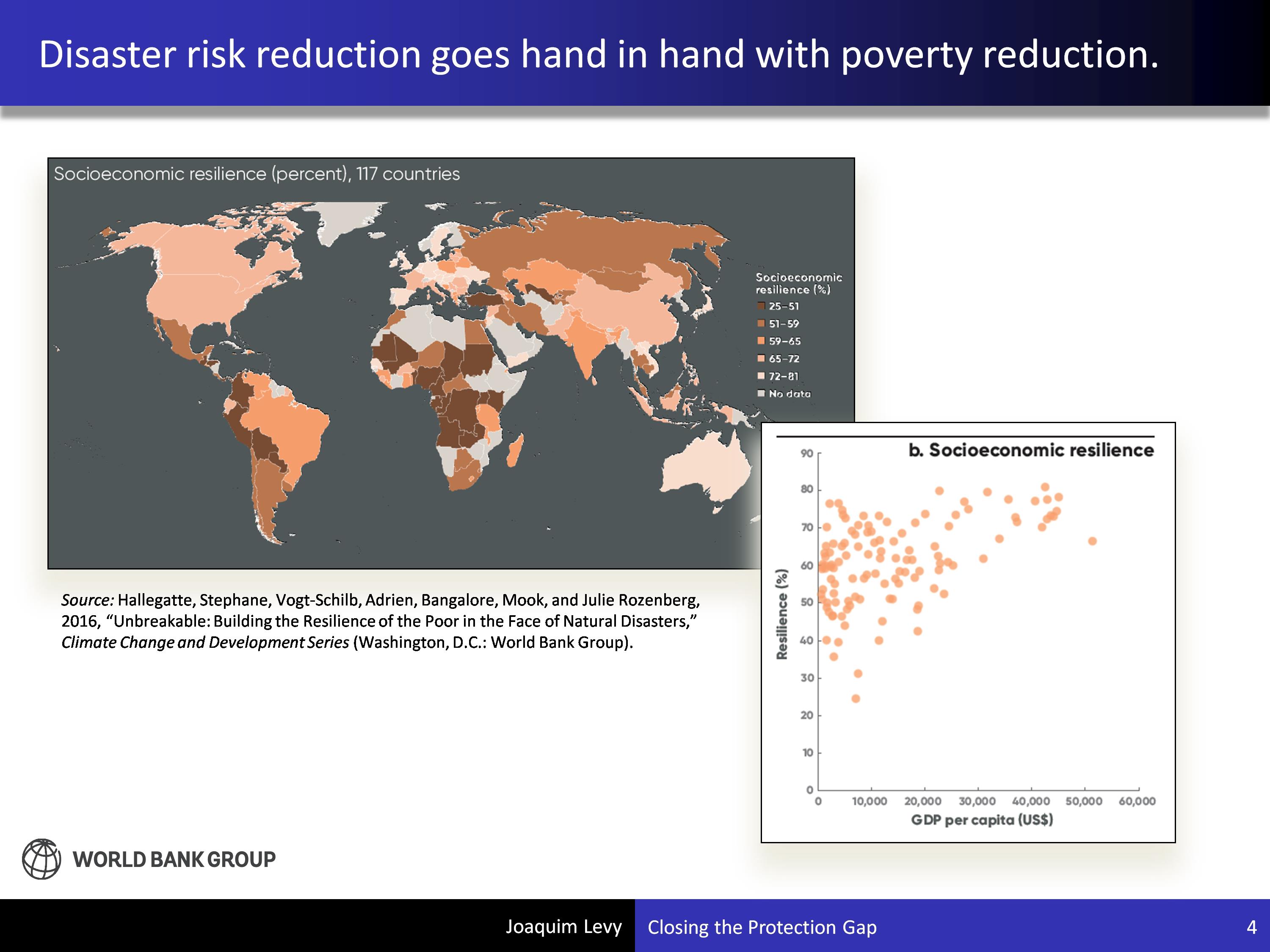

· Insurance coverage might be needed more in countries with a high degree of inequality, which is a major driver of socio-economic resilience. In addition, resilience to shocks also varies across countries of similar wealth suggesting that all countries, regardless of their geography or income level, can act to reduce risk by increasing resilience.

· The left chart in Exhibit 3 shows that the least resilient countries are mostly found in Africa and parts of South America but also in the Caucasus region. The right chart shows that, overall, resilience grows with GDP per capita. The fact that rich countries are more resilient than poor countries is not a surprise. Rich countries tend to have lower inequality, better access to finance for the poor, much better social protection, and a greater ability to provide those affected by a disaster with support. Targeted resilience-building interventions protecting poor people from adverse weather events would help countries and communities save $100 billion a year.

Exhibit 3

6. We know that higher insurance penetration can build more resilient societies; however, insurance coverage in most developing economies remains stubbornly low [see Exhibit 4]. Financial savings and insurance are used by only about 17 percent of people in low- and middle-income countries, compared with 45 percent of people in high-income countries. Catastrophe risk insurance penetration is even lower, usually less than 5 percent, in most developing countries (except countries like Turkey, where earthquake insurance is compulsory through the Turkish Catastrophe Risk Insurance Pool). So households and firms have to bear most of the losses themselves, especially in countries where fiscal means for post-disaster recovery and reconstruction are limited. In WBG client countries, uninsured individuals develop coping strategies to deal with disaster losses, such as cutting back on consumption. But these come at an extremely high cost, deterring long-term development.

Exhibit 4

Enhancing resilience through insurance

7. The WBG has been a staunch advocate of inclusive insurance to close this “protection gap” to ensure that more people have better access to insurance [see Exhibit 5]. The existing “protection gap” does not only stifle growth and limit lending opportunities. It also makes it harder to plan and implement projects that can benefit from World Bank assistance. And that is why we are part of this important conversation, together with donor countries.

Exhibit 5

8. Insurance enhances financial response capacity, and, thus, allows for a more comprehensive and effective recovery after disasters. As a development institution with a goal to end extreme poverty by 2030 and raise shared prosperity, we know that we can only get there if countries enhance their resilience, including by closing the insurance protection gap, to address future impacts of natural disasters and climate shocks.

9. Insurance is generally welfare-enhancing:

· Insurance mitigates the immediate adverse impact of disasters and helps reduce or avoid poverty. People that are not insured are likely to cut back on consumption and might not be able to pay for reconstruction and repair, delaying the recovery as a result.

· Paid insurance claims also have a long-term benefit well beyond the immediate event. By removing episodes of financial constraints, insurance provides an important source of long-term, domestic capital.

· Finally, let’s not forget the key issue in countries with a very high protection gap- governments can transfer some contingent liabilities, to the insurance (and capital) markets. In absence of insurance, the opportunity cost of is high. Usually funds allocated to long-term programs are “raided” to finance disaster recovery and reconstruction.

The World Bank Group’s activities

10. The WBG has developed a series of financial products and advisory services to support countries to increase their financial resilience to disasters [see Exhibit 6]. These customized solutions involve a diverse array of instruments, including credit lines, credit guarantees, risk pooling mechanisms, revolving funds, insurance, derivatives, and capital market mechanisms [e.g., catastrophe deferred draw down option, weather derivatives, cat bonds, cat pools, cat swaps among others].

Exhibit 6

11. Our work is characterized by a strong collaboration with the private sector in the area of inclusive insurance. Over the past 15 years, we have seen a growing number of client countries asking for more focus on risk management to help them solve complex problems. Together with the insurance industry, we have risen to address this challenge. The insurance industry plays a pivotal role in the way we build donor-funded risk-absorption capacity and mobilize private resources for innovative forms of risk-sharing aimed at closing the protection gap- effectively and efficiently.

12. The success of the Disaster Risk Finance and Insurance Program (DRFIP) is emblematic of our joint efforts in building donor-funded risk-absorption capacity together with the private sector. It acknowledges two important aspects of inclusive insurance.

· First, insurance is a key part of recovery effort after major disasters. When disasters strike, having access to the necessary funds makes all the difference.

· Second, insurance principles promote better risk management. By applying the discipline of insurance principles in scaling up of existing social safety nets, we can help reduce the negative impacts of shocks on the most vulnerable. Using data-driven, rules-based triggers ensures rapid, transparent, and accountable responses after a disaster or at the early stages of slow-onset disasters such as droughts.

Exhibit 7

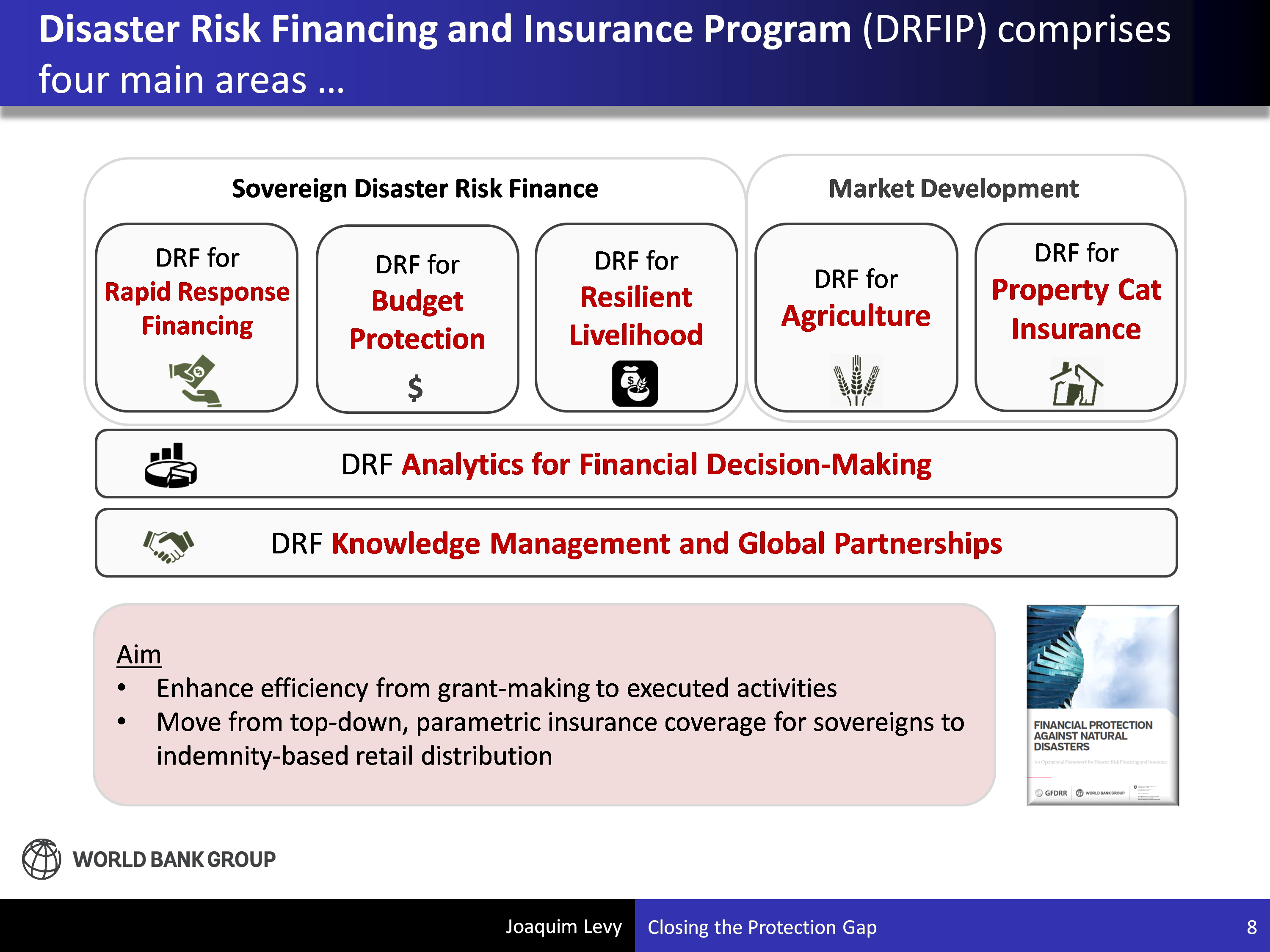

13. More specifically, the DRFIP comprises four areas- Sovereign Disaster Risk Finance, Market Development, Analytics, and Knowledge Management [see Exhibit 7]. Let me focus on just the first two components:

· Sovereign Disaster Risk Finance (‘Sovereign DRF’) enhances the financial response capacity of national and subnational governments to meet post-disaster funding needs through mechanisms aimed at:

o Providing rapid response disbursement,

o Managing budget volatility and contingent liabilities, and

o Financing scalable social protection mechanisms.

Thus, Sovereign DRF is reactive and provides remedies through post-disaster recovery, including budget support (contingent liabilities/volatility) and funding scalable social protection mechanisms for governments.

· In contrast, Market Development is proactive. It helps governments implement policy measures that are needed to incubate private markets that support greater financial resilience, such as sustainable, cost-effective public private partnerships in agricultural insurance and deeper disaster risk insurance markets for private property.

14. We see more and more interest by governments in Market Development. Countries are increasingly requesting support to improve their financial resilience, shifting their role from ex post crisis responders to ex ante risk managers. Our donor partners are also very supportive of this agenda, as recently illustrated by the G-7 Climate Risk Insurance Initiative (InsuResilience). This effort aims to increase the number of poor and vulnerable people covered against climate risk through (direct and indirect) insurance by 400 million by 2020.

Implementation issues

15. However, our efforts will only be effective and sustainable if we can install permanent incentives for investment in prevention and preparedness, supported by greater sovereign participation [see Exhibit 8]. For institutional reasons, governments may often not have the right incentives to invest in ex ante insurance. The post-disaster cost of losing productive assets is not priced ex ante. So there is considerable moral hazard of fiscally-constrained governments to “kick the can down the road” and potentially speculate on being bailed out at the expense of faster recovery. Budget allocations are decided by parliaments and setting aside money for insurance premia may not be politically expedient. In case no disaster occurs, some will consider the money set aside for disaster risk insurance a waste. Conversely, some governments with adequate reserves and healthy budgets might have the impulse to self-insure. We understand that some countries might also face legal and regulatory restrictions in purchasing disaster risk insurance.

Exhibit 8

16. The World Bank continues to strengthen local advocacy- educating governments and the public alike about the benefits of ex ante risk management [see Exhibit 9]. Smaller countries in particular can benefit significantly from regional risk pooling- such as in the case of the Caribbean Catastrophe Risk Insurance Facility (CCRIF)- which can bring down premia, and, thus, increase the likelihood of participation.

Exhibit 9

17. Similarly, in partnership with other donors, we secure greater buy-in from governments by shifting the emphasis to ex ante financial planning [see Exhibit 10]. In recent years, we have created new contingent financing instruments that allow countries to access liquidity after a disaster has occurred. Some of the mechanisms we have developed include:

· Loans with catastrophe draw-down option (CAT DDO), akin to a line of credit for budget support for governments triggered in the aftermath of a natural disaster, have been developed for more than 9 countries.

· A Capital-at-Risk Notes Program, which culminated with the issuance of the first IBRD CAT Bond in 2014, transferring US$30 million CCRIF catastrophe risk to capital markets.

· The forthcoming Pandemic Emergency Financing Facility (PEF), which will automatically pay out funds to affected countries through multilateral institutions, humanitarian agencies, and NGOs, if certain parametric triggers are met.

Exhibit 10

18. However, let me also be very clear on the current role of sovereigns in mitigating the financial impact of natural disasters and climate risk¾only if we eventually move to retail-focused insurance products will we be able to create sufficient advocacy for closing the protection gap. While governments are our natural counterpart, the sustainable expansion of insurance coverage has to be built from the ground up to permanently increase insurance penetration in developing economies. It should also be less dependent (or not dependent at all) on grants from advanced economies and rather be funded by beneficiaries themselves. One example of an indemnity-based retail product that would be a mandatory complement to private home insurance (as I mentioned earlier). The WBG also supports the development of local capacity through equity investments in primary insurers. To date, our private sector arm, the IFC, it has invested over $1 billion in more than 30 companies in developing economies.

The role of insurance in strengthening ex ante resilience

19. But insurance is only one tool for financial protection, which brings me to my final point- the role of infrastructure investment [see Exhibit 11]. Insurance is a powerful and very promising way of transferring risk, but it must be part of a comprehensive and multi-faceted approach to enhancing the resilience of countries. As much as we hope to see insurance coverage increasing especially in the most vulnerable countries, insurance helps reduce economic losses from the impact of disasters only after they have occurred. We equally hope to see the development of enhanced infrastructure that helps countries be better prepared before disasters occur.

Exhibit 11

20. Enhancing resilience through better infrastructure is especially important in cases when post-disaster losses have a social component outside possible coverage. Some assets that are destroyed by disasters may exhibit positive externalities. It means that their value to society is larger than the economic value to its owner. Public goods have this characteristic, among which include infrastructure projects, health services, and education services. And this applies to advanced and developing economies alike of course. One example is the road network and healthcare system in hurricane-stricken New Orleans. After Katrina’s landfall on the city in 2005, the poor state of local roads and the lack of health care services made it more difficult to attract construction workers to the region, and thus slowed down reconstruction.

Exhibit 12

21. At the World Bank, we have developed policies and instruments that facilitate investment in infrastructure supporting actions against climate change, especially in emerging markets [see Exhibit 12].

· We are helping attract investment in climate-smart infrastructure by helping governments develop a favorable legal environment and prepare projects, thus, lowering existing informational hurdles. For instance, we have created—with the help of donors and in partnership with other multilateral development banks—the Global Infrastructure Facility (GIF).

· We are also helping reduce the gap between the risk appetite of investors and the riskiness of infrastructure investment in emerging markets by making the range of guarantees offered by the World Bank Group, both at project and portfolio level, more understood and understandable. Here, the political risk insurance via our Multilateral Investment Guarantee Agency (MIGA) can be particularly appealing, as investment decisions are often dominated by political uncertainty.

· Finally, we are expanding financial products, such as green bonds, which seek to attract investment in resilience to natural disasters and climate risk, with more than 120 green bonds for US$9 billion in total issued by the World Bank thus far.

Conclusion

22. Ladies and gentlemen, I think all of us agree that closing the protection gap is not an end in itself- it is essential but not sufficient to enhance the resilience of countries to natural disasters and climate risk.

23. There still a lot of work ahead to build the solutions that help vulnerable countries enhance their resilience. Infrastructure development will be critical to continue the forward momentum. But we cannot do this alone. It is for this reason that we are keen to partner with the private sector to promote this agenda. From supporting appropriate insurance regulations, to building local capacity and developing risk models, and integrating this in comprehensive financial planning- our work can help leverage the full potential of insurance solutions for resilience.

Thank you very much for the opportunity to share these thoughts with you today. I look forward to the rest of the discussion.

[1] The presentation comprising all the slides that are referenced in the text can be accessed at the link on the top right section of this page. Moreover, Mr. Levy gave an interview to Munich Re, the organizer of the conference, about his views on the World Bank Group’s role in disaster and climate risk finance and related insurance activities. The interview is available at https://www.munichre.com/en/reinsurance/magazine/topics-online/2016/11/interview-joaquim-levy/index.html.

[2] Hallegatte, Stephane, Vogt-Schilb, Adrien, Bangalore, Mook, and Julie Rozenberg, 2016, “Unbreakable: Building the Resilience of the Poor in the Face of Natural Disasters,” Climate Change and Development Series (Washington, D.C.: World Bank Group).