Storm Daniel's Impact on Eastern Libya

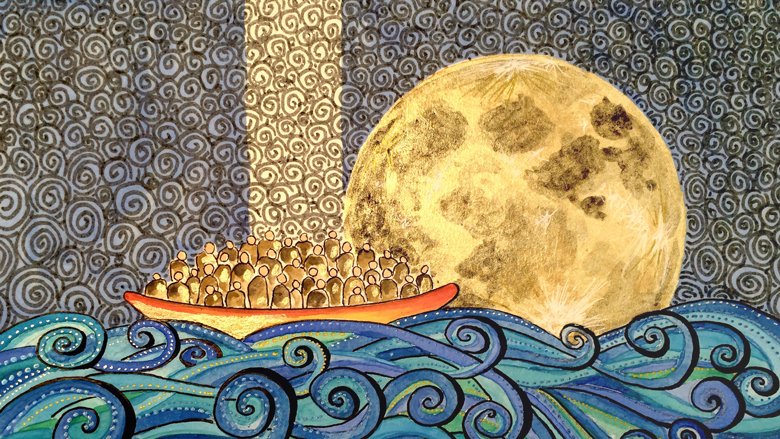

On Sunday, September 10, 2023, a devastating natural disaster unfolded in eastern Libya when Storm Daniel wreaked havoc with heavy rains and fierce winds. The storm's initial impact was felt across coastal cities of the northeast, including Benghazi, Sousse, and Al-Marj. However, the most catastrophic event occurred during the night of Sunday, September 10 to September 11, when two dams upstream of the coastal city of Derna, situated on the Wadi Darnah River, tragically failed. This led to the release of millions of cubic meters of water downstream, inundating the river plain and resulting in extensive flooding in Derna, a city inhabited by approximately 100,000 people. The flooding caused the complete destruction of entire neighborhoods, some of which were reported to have been swept into the Mediterranean Sea. The damage to buildings and infrastructure has been reported as severe, and numerous roads have been rendered impassable. As of September 18, 2023, the death toll reportedly exceeded 4,000, with more than 10,000 individuals still unaccounted for, and at least 34,000 people displaced from their homes. This catastrophic event in the eastern part of the country has unfolded during a period of continued descent into violence, political stalemate, and division. However, it is hoped the need for joint response and the desire to avoid further such disasters might incentivize positive developments in the political dialogue.

In response to the tragic flood disaster, the World Bank is developing a Rapid Damage and Needs Assessment (RDNA). The RDNA follows a global methodology to assess the extent of damages and losses incurred following a natural disaster or a conflict. Working with remote data and innovative technologies and engaging Libyan stakeholders in Tripoli and the affected areas, it seeks to estimate the cost of recovery and reconstruction. The assessment will guide and inform the recovery and reconstruction response to Libya’s tragic flood disaster. In addition, the World Bank is collaborating with local and international partners to inform the design of a cash transfer program for the affected populations. The World Bank will continue to support the disaster recovery and reconstruction process as it unfolds. The speed and effectiveness of Libya’s post-disaster reconstruction effort will largely depend on the unity of purpose and approach by all Libyan stakeholders.

Libya remains in a political stalemate with competing centers of power claiming legitimacy for control of the country. Negotiations have yet to reach an agreement on a constitutional framework that could pave the way to elections that would allow for the restoration of a unitary government. The contested legitimacy of political institutions and leadership contributes significantly to insecurity, economic loss, and social fragmentation.

A stable and secure Libya would have positive regional spillovers for two continents, given its strategic location at the gateways of Europe, Africa, and the Middle East. At the end of 2021, Libya ranked in the top 10 countries for globally proven oil and natural gas reserves, holding nearly 3 percent of these. In 2021, nearly 71 percent of Libya’s crude oil and condensate exports were imported to Europe (specifically Italy, Germany, and Spain). However, due to the protracted conflict, Libya’s oil production has been significantly lower than its capacity. Achieving stability and security could help Libya reach its goal of nearly doubling oil production by 2025, impacting the global oil supply. Stability in Libya could also help absorb economic migrants from neighboring countries, such as Tunisia and Egypt, as well as sub-Saharan Africa. Such developments would reduce pressure on Europe’s border management and help to increase the flow of remittances to countries of origin. A peaceful Libya would likely mean a reduction in arms- and human-trafficking, potentially leading to more stability in the Sahel region.

The Libyan economy, already battered by conflict, the COVID-19 pandemic, and the impact of Russia's invasion of Ukraine, will be further impacted by the catastrophic floods in the East. The country’s fragility is having far-reaching economic and social impacts. GDP per capita declined by 50 percent between 2011 and 2020, while it could have increased by 68 percent if the economy had followed its pre-conflict trend. This suggests Libya’s income per capita could have been 118 percent higher without the conflict. Economic growth in 2022 remained low and volatile due to conflict-related disruptions in oil production. World Bank experts estimate that in 2022, the Libyan economy contracted by 1.2 percent due to a blockade of oil production during the first semester. The labor market is characterized by high unemployment, with an official rate of 19.6 percent. More than 85 percent of those who work are employed in the public and informal sectors. Fiscal revenues increased by 16 percent in 2022, driven by higher oil earnings, which account for 97 percent of fiscal revenues. Public debt, mainly domestic, is high at 77 percent of GDP and 126 percent of government revenue. It is sustainable to assume hydrocarbon production and exports are not further impacted by the security and conflict situation. The increase in current spending is expected to be sustained in 2023, partly because of the adoption of the wage unification law in November 2022. Additionally, the Government of National Unity (GNU) registered a fiscal surplus of 2.5 percent of GDP in 2022, compared to 10.6 percent of GDP in 2021, despite a significant increase in hydrocarbon revenue.

Despite the numerous challenges facing the country, the Libyan economy could recover by leveraging Libya’s substantial financial resources, building on four critical pillars. The first is reaching a sustainable political agreement on the future of Libya. The second is the preparation of a shared vision of economic and social development that is evidence based and translates into a national budget to maintain critical infrastructure and build human capital. The third is the development of an accountable, transparent and decentralized public financial management system that ensures adequate sharing of oil wealth and inter-governmental fiscal transfers, as well as effective budget planning, execution, and reporting. The fourth is a comprehensive social policy reform to create a clear distinction between social transfers to those in need and public wages.

In 2022, the humanitarian situation improved, but vulnerabilities are likely to increase in late 2023 due to the floods in Eastern Libya. The United Nations Office for the Coordination of Humanitarian Affairs (OCHA) and the International Organization for Migration (IOM) reported that an estimated 43,000 people have been displaced in northeast Libya following the floods in September 2023. Moreover, the United Nations High Commissioner for Refugees (UNHCR) in Libya had reported that, prior to the floods, 49,000 refugees and asylum seekers were registered with the agency, including more than 1,000 in eastern Libya, in addition to some 46,000 internally displaced persons (IDPs) hosted across eastern Libya, the majority in Benghazi, Derna and Ajdabiya. Needs are greater among internally displaced persons, with health care, education, transport, and shelter as priority needs. As of September 25, humanitarian partners and local authorities have continued to scale up their operations to address the most urgent needs of communities affected by the floods.

Last Updated: Oct 12, 2023