Walid Benamor is an industrious man: his family business, La Pratique Electronique, has grown from just two employees when it was founded in 2001, to over 70 today. This makes him an outlier in a country which has seen its economy stagnate, and its unemployment levels remain stubbornly high, particularly during the slump that followed the 2011 revolution.

Although firmly grounded on Tunisian soil, under Tunisian law, La Pratique Electronique is considered an “offshore” company because it exports at least 70 percent of everything it makes. This means it is allowed to import its raw materials and components duty-free.

The alarm systems and LED lighting units that La Pratique Electronique makes in Tunisia are used for car assembly plants, airports and supermarkets, mainly in France, making it, for many, the kind of success story that epitomizes Tunisia’s economic model, which gives large tax incentives to companies manufacturing exports as part of its Investment Incentives Code. In recent years, however, calls by economists and businessmen for changes to be made to the code have increased, and the Tunisian government has been studying if and how the system should be reformed.

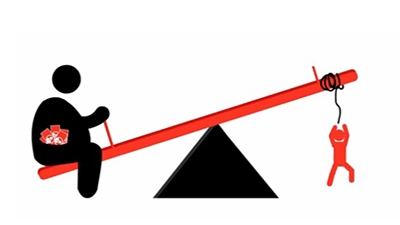

The code draws a distinction between “onshore” and “offshore” companies. Its supporters say incentives provided to offshore companies make Tunisia more attractive to foreign investors, with the offshore sector’s relatively limited regulations protecting them from the corruption and red tape faced in the onshore sector. They also say the system protects Tunisia’s domestic labor market from the “race-to-the-bottom” of global market, as countries compete to produce cheap exports with cheap labor.

How the onshore–offshore system works in practice, though, does not substantiate either argument. The offshore sector has indeed attracted large-scale foreign investment, but the reality is that overall investment levels remain low and Tunisia lags behind its closest competitors. Investors’ surveys show that investment incentives, which amount to approximately two percent of Gross Domestic Product, are largely wasted. “Roughly 80 percent of the US$850 million Tunisia spends annually on tax incentives to the offshore sector is a waste,” said Antonio Nucifora, lead-author of the recently released World Bank report, The Unfinished Revolution, Bringing Opportunity, Good Jobs and Greater Wealth to all Tunisian. “The companies we surveyed said they would have invested in exactly the same way, with or without the tax breaks,” he added.