Kamojang Geothermal Power Plant in Indonesia. © Akhmad Dody Firmansyah/Shutterstock

In Indonesia, some 20 million people lack access to electricity—a significant challenge facing this diverse archipelago. At the same time, the country is working to keep up with the growing energy demands of a middle-income economy, while meeting its national commitments to produce 23 percent of its energy from renewable sources by 2025 and reduce carbon emissions by 29 percent by 2030.

Fortunately, Indonesia’s geography presents a unique opportunity: The country is home to 40 percent of the world’s geothermal reserves. Developing this resource could both service areas with high electricity demand and alleviate poverty through electrification in rural areas.

Yet, new geothermal energy sites come with high costs and substantial risks that have often proved too prohibitive for developers. Exploration can cost between $30-$50 million, with no way to recoup losses if the geothermal resource proves insufficient. Later stages of development are less risky but more costly—requiring up to $400 million to develop a 100-megawatt site. With hundreds of potential sites across the country, billions of dollars in investments will be needed to tap the potential of geothermal power in Indonesia.

With challenges like this in mind, the Building on efforts to mobilize needed resources for member clients, the Bank Group’s Maximizing Finance for Development (MFD) approach is systematically leveraging all sources of finance, expertise, and solutions to support developing countries’ sustainable growth.

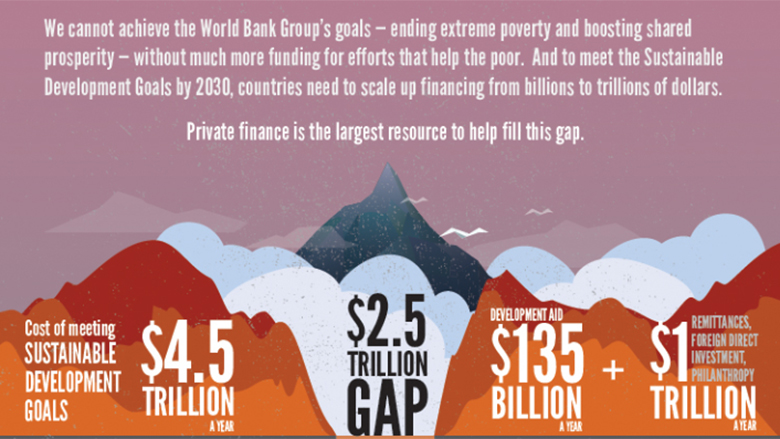

Even when development aid is combined with remittances, foreign direct investment, and philanthropy, the world faces a $2.5 trillion financing gap every year.

View full infographic here

The MFD approach focuses on efforts that provide the right mix of resources to help countries move quickly toward meeting their development goals. This includes a much bigger role for the private sector as a source of finance, innovation, and expertise.

By engaging the capabilities from across the World Bank Group’s institutions, MFD seeks to optimize the use of public resources and expand opportunities to attract and employ private resources to meet development needs, without burdening countries with unsustainable debt or contingent liabilities.

Indonesia’s geothermal challenge is a good example of how MFD can support development in practice. To reduce the hurdles to its geothermal development, the World Bank and the International Finance Corporation (IFC) are working with the country to unlock private investment.

To close financing gaps and mitigate risks, the World Bank is helping the government establish an innovative credit facility that will channel $650 million into geothermal exploration. This includes $150 million from the government, $175 million in concessional climate finance, and $325 million in loans from the World Bank. By supporting early-stage geothermal development, the financing is expected to unlock $4 billion in potential private sector investments.

In parallel, IFC has provided critical advice on how to structure the facility to align with the needs of the private sector. IFC is developing a financing instrument that will kick in once private investors pass through the high-risk exploration phase. This instrument is designed to bridge the gap between the Bank Group’s financing and the finance needed for a fully-functioning geothermal power station.

The support from the World Bank Group, coupled with the private finance, is projected to develop a gigawatt of capacity through 20 new geothermal sites throughout the country—enough to power about a million homes.

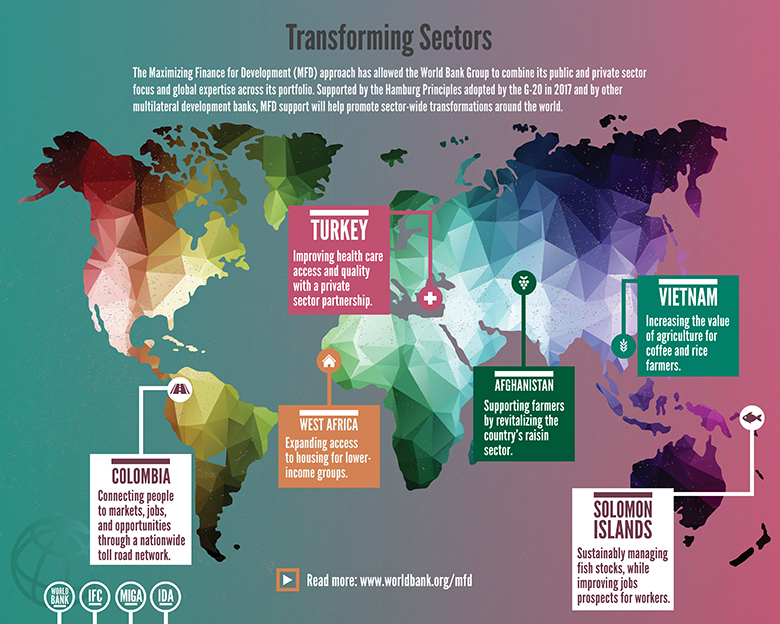

By systematically bringing together the ideas, tools, and resources countries need, the Bank Group is now looking at how the MFD approach can help create sector-wide transformations.

Overall, the Bank Group is actively working with nine countries—Cameroon, Côte d’Ivoire, the Arab Republic of Egypt, Indonesia, Iraq, Jordan, Kenya, Nepal, and Vietnam—that have asked for assistance in crowding in private solutions for development. These MFD pilots build on the existing partnerships with these countries to re-energize, re-prioritize, or add new activities that unlock newly identified opportunities.

The World Bank Group has also developed a new tool, the Infrastructure Sector Assessment Program, or InfraSAP. With this instrument, it will partner with client governments to create a plan for improving infrastructure performance among different sectors. Indonesia was one of the first countries to request an InfraSAP review, which looked closely at four key sectors—energy, transport, water, and urban development—to identify opportunities within the country’s goals and to develop a plan for financing and delivering on them.

Supported by the Hamburg Principles adopted by the G-20 in 2017 and by other multilateral development banks, MFD support will help promote sector-wide transformations around the world.

Read more: www.worldbank.org/mfd

With the Maximizing Finance for Development approach, the Bank Group strives to mobilize the best mix of public and private sector solutions, expertise, and financing to help grow economies, reduce poverty, and expand opportunity for all.