New technologies are often caught in a bind.

Their true value only emerges once people begin to use them, but until they have a proven track record few are willing to try. Breaking out of that bind and establishing a track record requires someone with vision – who can both recognize the potential inherent in a new technology and willing to take the risk to unlock it.

That was the case with Concentrated Solar Power (CSP) in the Middle East and North Africa (MENA) region, until Morocco launched its bold program to invest in the technology. With the first phase of the 500 MW NOOR project coming on line earlier this year, the 160 MW NOOR I plant, Morocco is providing an example to the region of the value of CSP.

Learning from NOOR

It was to study the example of NOOR that government officials and energy and finance experts gathered in Casablanca, Morocco earlier this year. The aim was to share knowledge and build networks to catalyze the development of CSP in a region ideally suited to the technology due to its abundant sunshine. The conference was co-hosted by the Moroccan Agency for Solar Energy (MASEN) - in charge of leading the country’s shift to renewable energy - the Climate Investment Funds (CIF) and the World Bank Group (WBG). The CIF and the WBG have partnered around the goal of supporting the installation of 1 GW of CSP generation capacity in the region through the US$750 million Clean Technology Fund (CTF) MENA CSP Investment Plan.

One of the first lessons, delivered by the president of MASEN, Mustapha Bakkoury in his opening remarks to the conference, was that Morocco was not committed to a particular technology. Morocco was committed to breaking its dependence on imported fossil fuels and to taking action on climate change. To meet this goal, a target was set of meeting 42% of its power generating capacity needs through renewables by 2020– a figure that was raised to 52% by 2030 at last year’s climate talks in Paris, France. It was in figuring out how to meet the country’s current and future energy needs within this national plan that CSP was identified as a solution.

In response to the market research that MASEN conducted, the national power utility made clear that its greatest need was in the early evening once the sun had gone down. That was when demand for electricity reached a peak. CSP, with its thermal storage, could be depended upon to meet that demand. While photovoltaic has far lower capital costs, it can only generate electricity when the sun is shining. In recognition of the true value of CSP, Morocco was ready to invest.

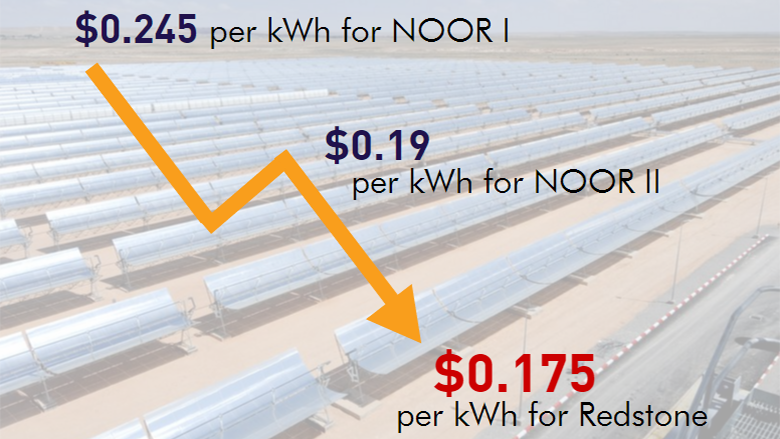

Another lesson was the importance of concessional financing, in the short and medium term, in meeting the greater capital costs of CSP. The CIF provided $435 million in concessional financing, which was used to leverage more than $3 billion from the World Bank Group, the African Development Bank and other European financing institutions. For the international financial institutions it was an opportunity to support the development of a new technology that could play a critical role in the global shift to renewable energy – a global public good. The investment in the technology, particularly in MENA, will make a big contribution to bringing down the cost of CSP globally. Morocco’s sunny climate and temperature will stretch subsidy dollars much further than investments in other regions. Along with contributing to the global goal of shifting away from fossil fuels through the development of renewable energy technology, for Morocco it is a way of harnessing their natural resources to meet the national goal of building their energy independence with a clean and dependable source of power.