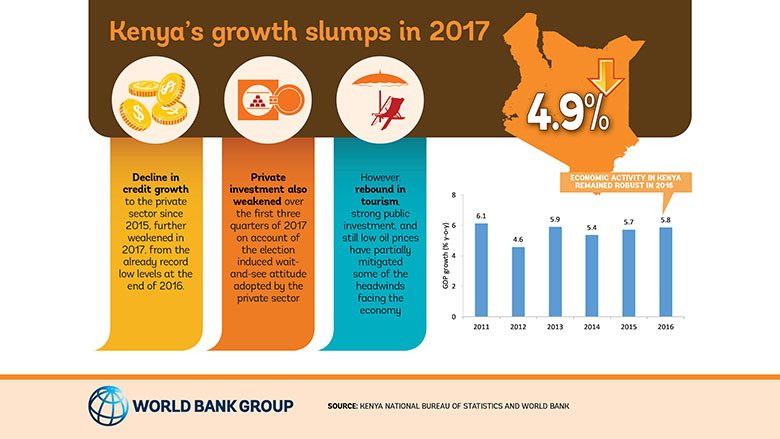

KENYA, December 7, 2017—A decline in the private sector's access to credit since 2015 partly accounts for the recent slowdown in Kenya’s economic performance, according to the 16th edition of the World Bank's Kenya Economic Update, Poised to Bounce Back? Reviving Private Sector Credit Growth and Boosting Revenue Mobilization to Support Fiscal Consolidation.

Election-related uncertainty also weakened private sector activity, further constraining its growth. The Kenya Private Sector Alliance says the sector lost an estimated $7 billion—equivalent to about 10% of Kenya's GDP—from the effects of the heightened sense of uncertainty the 2017 general elections created. Kenya’s economic

Other drivers of the downturn were the poor seasonal rains that reduced crop production and limited the generation of hydroelectric power for much of 2017. The late 2016/early 2017 drought meant that food prices rocketed, and the electricity generation agency increased power tariffs, putting inflationary pressure on households and businesses.

With agriculture a major source of employment and the largest single economic sector— accounting for 25% of GDP and roughly 50% of export revenue, according to the Kenya National Bureau of Statistics—drought has a huge impact on Kenya's economy. Farming is largely rain-fed, with worsening cycles of drought affecting food production for local consumption, as well as

As a result, Kenya’s GDP growth for 2017 is expected to drop to 4.9%, its weakest in five years. Despite this slump,

In the medium-term, growth in the Kenyan economy is forecast to recover to 5.5% in 2018 and 5.9% in 2019, though this is contingent upon its implementation of supportive economic reforms and its prudent management of macroeconomic stability.

Key among these reforms is the need to facilitate and strengthen credit growth to the small and medium enterprises that have been the drivers of Kenya’s economy. Improved access to credit requires lowering the cost of credit, removing the interest rate cap, the universal adoption of credit scoring, and accelerating the collateral registry.